How to Get Power of Attorney in California

In the world of estate planning, few documents wield as much authority as a Power of Attorney. This legal document grants an individual the power to act on behalf of another person in specific matters, offering a crucial tool for managing your affairs when you’re unable to do so yourself. Adult children with aging parents who are losing physical and/or mental capacity may wonder how to get a Power of Attorney to help their parents manage their finances or healthcare. Here is an overview of how to get a Power of Attorney in California.

What is a Power of Attorney?

Before delving into the specifics of California law, let’s clarify what a Power of Attorney (or POA) entails. Simply put, it’s a legal document that grants an individual (the agent or attorney-in-fact) the authority to act on behalf of another person (the principal) in various capacities. This authority may include managing financial and/or health care decisions, depending on the type of POA established.

Types of Power of Attorney

In California, here are some of the most common types of Powers of Attorney

- Durable Power of Attorney: This is the most common type of POA, often included in estate planning packages. It’s called “durable” because it remains in effect even if the principal becomes incapacitated, providing continuity in decision-making.

- Healthcare Power of Attorney (aka Advance Healthcare Directive): Authorizes the agent to make medical decisions on behalf of the principal if they are unable to do so themselves.

- General Power of Attorney: Grants broad powers to the agent, allowing them to make both financial and legal decisions on behalf of the principal. Powers granted by this document may allow the agent to sell property, manage real estate, and enter contracts on behalf of the principal. This document becomes invalid if the principal becomes incapacitated.

- Limited (or Special) Power of Attorney: Confers specific powers to the agent for a limited time or purpose, often used for a particular transaction or during the principal’s absence. For example, if you plan to leave the country and need to appoint an agent to handle real estate transactions in your absence, you might establish a Limited POA for this purpose.

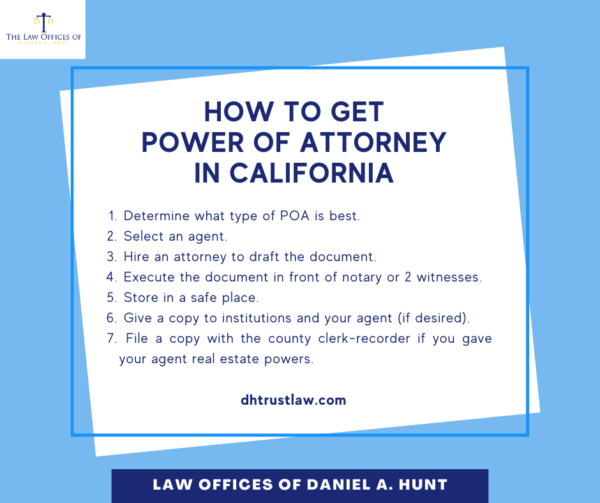

Steps to Obtain Power of Attorney in California

If you or a loved one wishes to establish a Power of Attorney, you need to understand the process to create this document. Here are the basic steps involved:

- Determine the Type: Consult an experienced estate planning lawyer who can advise you on which type of POA is most appropriate for your circumstances. Choose the appropriate type for your needs.

- Select an Agent: The principal should choose a trustworthy and capable individual to act as the agent. The agent should be someone who understands the responsibilities and is willing to act in the best interests of the principal at all times.

- Draft the Document: California requires specific language and formatting for valid Power of Attorney documents. While it’s possible to sign a Power of Attorney form without legal assistance, hiring an attorney to draft the document ensures compliance with state laws and tailoring the document to fit your unique needs.

- Execute the Document: Depending on the type of Power of Attorney, it may require to be signed in front of a notary public or two unrelated, disinterested witnesses, meaning a witness who has nothing to gain from the document.

- Store Safely: Store the original POA somewhere safe that your agent can easily access, and let know where to find it. You can also give a copy to your named agent if desired.

- Distribute Copies: Provide copies of the executed POA document to relevant parties, such as financial institutions or healthcare providers. Ensuring that key stakeholders are aware of the agent’s authority can facilitate smooth decision-making processes when the need arises.

- File a Copy with the County Clerk-Recorder: If you granted “real property transactions” as one of the powers you granted to your agent, you may consider recording a copy of your POA with the County Clerk-Recorder of any county where you own real estate. This will allow their office to recognize your agent’s authority if your agent ever needs to sell, mortgage, or transfer real estate for you.

How to Use a POA

When can you begin using a Power of Attorney? It depends on the language used in the POA, but most are effective immediately unless otherwise stated.

When acting on behalf of the principal, an agent would need to provide a copy of the POA to the institution. For example, if you need to make a withdrawal from the principal’s bank account, you should show the bank employee a copy of the POA.

There are some tasks that an agent cannot complete on behalf of the principal, even with a POA. An agent cannot:

- Vote on behalf of the principal in political elections

- Enter into a marriage for the principal

- Act in any way against the principal’s best interests

- Commit the principal to a mental health facility or consent to convulsive treatment, psychosurgery, sterilization, or abortion on behalf of the principal (thanks to recent law changes)

When Does Authority End?

All Powers of Attorney end upon the death of the principal. This means the agent’s authority to act ends when the principal passes away. If the principal dies, the agent should immediately cease to use the POA or they risk being accused of Power of Attorney abuse. After the principal’s death, the estate will be managed by either the executor of their will or their successor trustee if they created a trust.

A POA would also end if:

- The principal revokes the document.

- None of the agents listed in the document are able to act.

- A court invalidates the document.

Seek out an experienced estate planning attorney who can guide you step-by-step through the process of creating this powerful document. If you have any questions about how to get Power of Attorney in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.