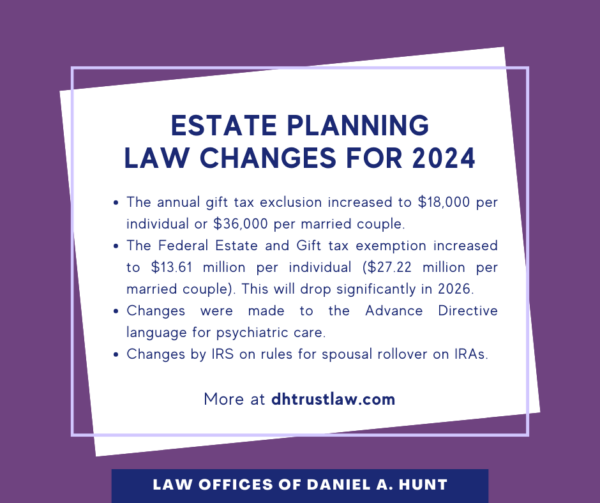

Top Estate Planning Law Changes for 2024

Every year, our law firm updates our clients regarding changes in estate planning law that may affect them. Here are the top estate planning law changes for 2024 that every Californian should know.

Gift Tax Exclusion

The gift tax exclusion amount in 2024 has increased from last year when it was $17,000 per individual or $34,000 per married couple splitting their gifts. The new amount for 2024 will be $18,000 per individual or $36,000 per married couple. This means you can give up to $18,000 to as many people as you wish without those gifts counting against your lifetime exemption.

Federal Estate Tax Exemption

The Federal Estate and Gift Tax exemption has once again increased to $13.61 million per individual (or $27.22 million for a married couple), up from $12.92 million in 2023. This means that you can give away a total of $13.61 million of assets over the course of your life and at your death without owing any Federal Estate tax.

However, change is on the way! In 2026, the tax exemption will drop much lower to an estimated $7 million per individual ($14 million per married couple). In addition, the current 40% maximum gift and estate tax rate will increase to 45% (the highest estate tax rate since 2009).

Concerned that this change will impact your estate? Check out our blog post about estate planning strategies you can use now to prepare. When you’re ready, contact us to schedule an appointment with one of our attorneys to discuss a game plan!

Changes to IRA Rollovers

In a Private Letter Ruling (PLR) 202322014, the IRS decided that when the surviving spouse is the sole executor and sole residuary beneficiary of an estate which is the beneficiary of the decedent’s IRA, the surviving spouse may complete a spousal rollover of the IRA within 60 days of the date the proceeds of the IRA are paid to the estate.

Future Potential Change

One potential future change to be aware of is Assembly Bill 259, a California wealth tax that was rejected in 2023 but is gaining traction in the Capitol. This bill would impose a 1.5% tax on California residents with a net worth of over $1 billion as soon as 2024.

There are an estimated 186 billionaires in California, so if passed, this bill would affect less than 0.1% of Californians. Please come see us if you are a billionaire.

Change to Agent’s Authority for Psychiatric Care

In 2022, the Probate Code was clarified to provide that an agent who has authority to make healthcare decisions for a person generally may make decisions for not just physical but also mental health. But in 2023, Assembly Bill 1029 amended the Probate Code to emphasize that an agent cannot make certain specified decisions.

The following language was added: “…your agent will not be able to commit you to a mental health facility, or consent to convulsive treatment, psychosurgery, sterilization, or abortion for you.”

A new section, Probate Code §4701, was also added which allows for a “psychiatric advance directive” if desired. This is a legal document that allows a person with mental illness to protect their autonomy and ability to direct their own care by documenting their preferences for treatment in advance of a mental health crisis.

California Case Law Updates

Here are select 2023 California case law findings that carry valuable takeaways:

- Algo-Heyres v. Oxnard Manor LP: A trial court properly denied a skilled nursing facility’s petition to compel arbitration of claims for medical malpractice, elder abuse, and related torts brought by the family of a deceased resident. The resident was determined to lack the legal capacity to enter into a contract, so the arbitration agreement couldn’t be enforced.

Lesson learned: Incapacitated individuals in nursing homes cannot execute legal documents, including arbitration agreements.

- Zahnleuter v. Mueller: A successor trustee of a family trust pursued the interests of his two daughters in a litigated matter over a trust amendment. Because of this, a trial court ruled that the trustee must pay his own litigation costs instead of the trust paying these costs.

Lesson learned: Trustees must remain neutral in litigated matters and never favor one beneficiary over another.

- Pool-O’Conner v. Guadarrama: An attorney-in-fact deposited $200k that belonged to the power of attorney holder into a joint account and created a survivorship interest in the funds, which resulted in a change of the beneficiary designation to himself. The probate court ordered him to return the money he had withdrawn during the decedent’s lifetime, since the money belonged to the decedent alone.

Lesson learned: Power of Attorney agents should be careful to avoid commingling personal funds with assets that belong to the POA creator.

- Diaz v. Zuniga: A settlor’s purported amendment of a revocable trust didn’t meet the requirements laid out in the trust. The trust required the settlor to send the document by certified mail to himself, but the settlor did not do so.

Lesson learned: Never attempt to amend your trust on your own without the guidance of an experienced estate planning attorney. A seasoned trust lawyer can ensure that you properly follow all steps your trust requires to create an amendment.

- Estate of Berger: The appellate court held that a probate court may consider extrinsic evidence of the circumstances surrounding the document’s execution if there is ambiguity. In this case, a letter did not meet the two-witness requirement for a will, but there was clear and convincing evidence that the decedent intended the letter to be testamentary.

Lesson learned: While the person named in the letter as the sole beneficiary got lucky in this case, the proceeding would not have been necessary had the decedent worked with an experienced estate planning attorney and executed the will properly with two witnesses.

If you have any questions about these top estate planning law changes for 2024 or would like to schedule a consultation with one of our attorneys to discuss how they might impact you, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.