NFTs and Estate Planning

Cryptocurrency isn’t the only new digital asset that has become popular in recent years. If you’ve purchased nonfungible tokens (NFTs), you may have wondered how such assets will interact with your estate plan after your death. Here’s an overview of NFTs and Estate Planning.

What is an NFT?

A nonfungible token (NFT) is a unique, collectible, tradable digital asset. While they exist on the blockchain, they cannot be traded for equal value like cryptocurrency. They can only be purchased on an NFT marketplace through a bidding process.

NFTs provide value to collectors by giving them the ability to own unique works of digital art, just like physical art or rare baseball cards. Some are priced quite reasonably, while others have sold for tens of millions of dollars. Like cryptocurrency, NFTs can only be accessed through a private key.

Tips for Estate Planning with NFTs

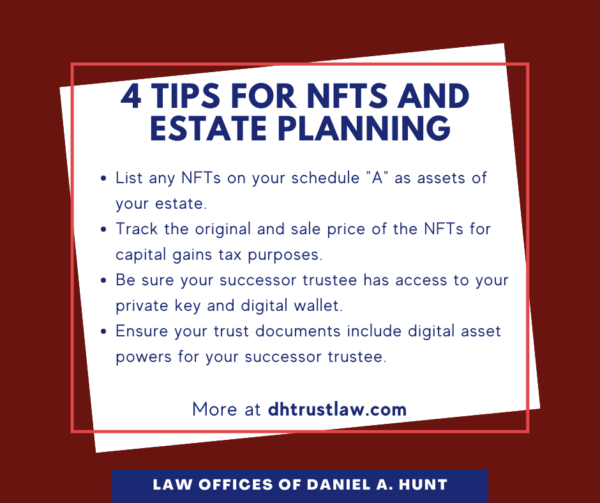

Technology evolves faster than the law, so the interaction between NFTs and estate planning is quite new and still developing. But here are a few tips to help you ensure your NFTs can be dealt with after your passing.

#1 List your NFT as estate assets. If you haven’t created an estate plan yet, be sure to include NFTs amongst your assets in the initial questionnaire you’ll fill out when meeting with an estate planning attorney for the first time, especially if it’s a valuable item. Your attorney can advise you how best to deal with this asset.

If you already have an estate plan, be sure to update your Schedule “A” and list your NFT. This will communicate to your trustee that the asset exists so they can track it down.

#2 Track the original and sale prices. Carefully track the price paid for the NFT and amount you receive upon sale. These assets can accrue capital gains and losses, so you’ll need to track these amounts and pay taxes accordingly.

#3 Leave your successor trustee access information. Keep detailed records for your successor trustee of the NFT assets you own, the digital wallets in which they’re stored, and the personal key. Your successor needs this information to access, secure, value, and liquidate or transfer your digital assets. Just like cryptocurrency, an NFT could be lost forever if no one has the access information.

Can You Transfer NFTs to a Trust?

At the time of writing, an NFT cannot be retitled in the name of a revocable trust. But if you own a high-value NFT that is outside of a revocable living trust, it could trigger a probate proceeding after your death if it exceeds the California probate threshold.

How can you avoid a California probate after your death in this situation? When you create your estate plan, be sure that your trust documents include digital asset powers for your successor trustee. This will grant your successor access to digital assets including NFTs after your death.

If your estate planning documents are more than five years old, you should have them reviewed by an estate planning attorney to ensure these powers are included in your trust.

If you invest in NFTs, be sure to ask an experienced estate planning attorney for legal advice to ensure that none of your assets fall through the cracks. If you have any questions about NFTs and estate planning, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.