Cryptocurrency and Estate Planning

By the end of 2022, nearly 34 million US adults (or around 13% of the population) are expected to own at least one form of cryptocurrency. Cryptocurrency is a relatively new issue in the estate planning field and is still evolving. If you own cryptocurrency, it’s critical to consider how your digital assets will interact with your estate plan and to take steps to ensure they aren’t lost after you die.

Understanding Cryptocurrency

Cryptocurrency is a digital form of currency that uses cryptography to secure transactions. Cryptocurrencies don’t have a central issuing or regulating authority, but instead, use a decentralized system to record transactions and issue new units.

Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders. Cryptocurrency is stored in digital wallets and secured by the use of a secret 64-digit private key which is used for all transactions.

A few popular types of cryptocurrency include:

- Bitcoin

- Ethereum

- Binance Coin

- Tether

- Solana

- and more

Challenges for Estate Planning

Cryptocurrency and estate planning pose a number of challenges. Because it is not a physical asset, cryptocurrency operates differently than most traditional assets that may be left behind when a person passes away. Here are three challenges digital currency poses for estate planning:

Challenge #1: Knowing where to access digital currency.

As a virtual asset, crypto may be stored on a USB drive, a hard drive, or another location that’s easily overlooked by your successor, especially if you’ve chosen someone who doesn’t understand how cryptocurrency works. Accessing your digital assets may be a challenge for your successor.

Challenge #2: Lack of personally identifiable information.

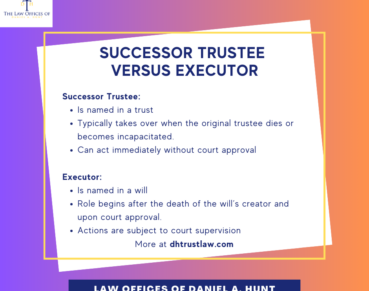

When you create a revocable living trust, you transfer most assets into your name as trustee of your trust. But a crypto wallet isn’t associated with a name or social security number. Nor does it have a certificate of title, a deed, or an account statement reflecting your ownership. Because of this lack of personal information, cryptocurrency often can’t be transferred into a trust like other assets.

Challenge #3: Losing your private key.

A digital wallet can’t be accessed at all without a private key. For security reasons, this key must be kept confidential while you’re alive to protect you from fraud. But if your successor cannot find it after your death, they will be unable to access your digital assets. All of those assets will be lost and there will be no way to recover them.

Tips to Overcome Challenges

The key to overcoming these challenges is to disclose your digital assets to your successor trustee and leave clear directions on how to access your digital wallet. Here are a few ways to do this:

- Write a letter of instruction outlining your digital assets and how to access them. Send a copy of this letter to your attorney for your estate planning file.

- Consider sharing your private key with your successor trustee while you’re alive or at least tell them where to find it when the time comes.

- Consider using a digital vault, a secure online platform where you can maintain your digital assets and logins and share access with the people you trust.

Avoiding Probate with Cryptocurrency

If you own a large amount of cryptocurrency and it is outside of a revocable living trust, it could trigger a probate proceeding after your death if it exceeds the California probate threshold. While some wallets allow you to open an account in the name of a trust or to name a trust as a beneficiary of your account, many do not.

How can you avoid a California probate after your death in this situation? When you create your estate plan, be sure that your trust documents include digital asset powers for your successor trustee. This will allow your successor to manage digital assets including cryptocurrency after your death. If you have an estate plan that is more than five years old, you should have it reviewed by an estate planning attorney and ensure these powers are included in your trust.

If you invest in cryptocurrency, be sure to work with an experienced estate planning attorney for legal advice to ensure that none of your assets fall through the cracks. If you have any questions about cryptocurrency and estate planning, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.