Who Needs a California Conservatorship (and Who Doesn’t)

Determining who needs a California conservatorship (and who doesn’t) can be challenging. Conservatorships can be expensive, difficult to obtain, and demanding to maintain. Before seeking a long-term conservatorship, you should understand who qualifies for a conservatorship, who doesn’t, and when another strategy can be used instead.

What is a Conservatorship?

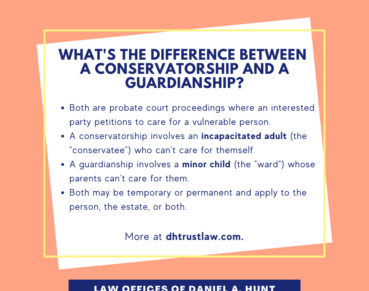

A conservatorship is the transferring of one person’s rights (the conservatee) to another person (the conservator), allowing the conservator to act on behalf of and for the benefit of the conservatee. A legal conservatorship is established when a Judge determines that an adult is unable to manage their affairs and appoints another person to do so on their behalf.

A conservatorship is generally only necessary for individuals who have no estate planning documents in place. But occasionally the court removes a trustee/agent who violates their fiduciary duties and establishes a conservatorship instead.

There are two main parts to a conservatorship:

- Conservatorship of the Estate (primarily pertains to financial matters)

- Conservatorship of the Person (primarily pertains to physical care)

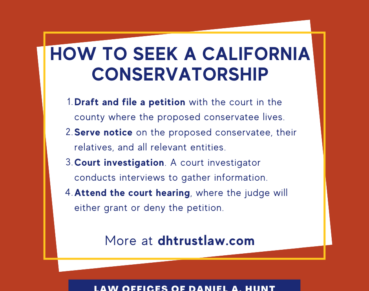

Obtaining a California conservatorship is a long and expensive process. Generally, the cost ranges from $5,000-8,000 or more. The process varies by county, but on average, requires 3-6 months to be established.

Once established, the conservator must document their actions and report back to the court regularly. Conservatorships are closely monitored by the court to protect the vulnerable conservatees.

Who Needs a Conservatorship?

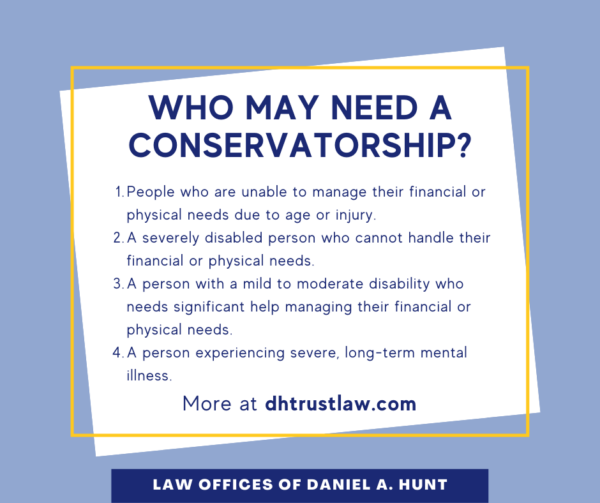

Conservatorships primarily benefit people who have permanently lost the capacity to care for themselves, physically or financially or both. A suitable conservator can ensure the conservatee is protected from neglect and from those who would take advantage of their vulnerability.

Here are some examples of people who may need a conservatorship:

- People who are no longer able to manage their finances or care for themselves, due to age or injury.

- A severely disabled person who cannot handle their financial or physical needs.

- A person with a mild to moderate disability who needs significant help managing their financial or physical needs. For example: an adult child with Down Syndrome.

- A person experiencing severe, long-term mental illness (such as schizophrenia or bipolar disorder) which renders them frequently unable to handle their financial or physical needs.

Who Doesn’t Need a Conservatorship?

Because of the cost and long-term nature of a conservatorship, it is a poor fit for those who experience temporary reduced capacity or who are likely to regain capacity in the immediate future. Here are a few common examples:

- A person experiencing mild to moderate addiction, such as a drug or alcohol addiction. Most addicts experience periods of sobriety during which they can function and care for themselves. Trying to help them achieve sobriety is usually a better alternative than a permanent conservatorship.

- A person who experiences mild to moderate mental illness. Many people who experience mental illness experience functional periods. Trying to help them find appropriate treatment is usually a better alternative to a permanent conservatorship.

- A person who is currently ill but is likely to recover in the future. Due to the cost and long-term nature of a conservatorship, it usually isn’t worth seeking a permanent conservatorship if they are likely to recover.

Alternative Strategies to a Conservatorship

The best alternative to a conservatorship is to take action while the person in question still has the capacity to execute legal documents. If they understand the nature of their situation and assets and can express their desires, then they have the legal capacity to create estate planning documents. A Durable Power of Attorney and Advance Healthcare Directive allow them to designate an agent to act on their behalf.

If the person has a joint bank account with someone else on title, that person may be able to assist in handling financial matters.

For care of physical needs, an informal arrangement may be another alternative to a formal conservatorship. For example, an elderly grandparent might move in with a trustworthy grandchild who acts as an informal caregiver.

If the person is close to death, the best option may be to wait until they have passed and handle the financial situation post-death. Since it takes on average 3-6 months to secure a conservatorship, it may not be worth the cost and effort required.

If you have any questions about whether or not someone needs a California Conservatorship, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.