What to Do with an Inherited IRA

Individual Retirement Plans (IRAs) are common assets that many people acquire during their lifetime. When the original owner of an IRA dies, their spouse or their successor(s) named in their estate plan must decide how to deal with this asset. If you’re wondering what to do with an inherited IRA, the answer depends on a number of factors.

If You’re a Spouse

While an IRA can be left to a person, an estate, or a trust, the spouse has the best options. A spouse can simply take over the account in a spousal transfer, and the IRS will treat it as if it were yours all along.

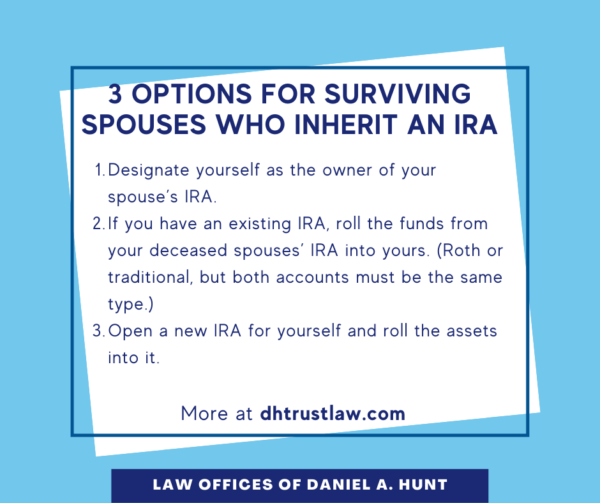

If you were the sole beneficiary of your spouse’s IRA, here are three possible ways to deal with the account:

- You can designate yourself as the owner of your spouse’s IRA.

- You can roll the funds from your deceased spouse’s IRA into your existing IRA if you own one. Your IRA can be either Roth or traditional, as long as it has the same tax treatment as your spouse’s IRA.

- You can open a new IRA for yourself and roll the assets into it.

If You’re a Non-Spouse

If you’re not a spouse or you’re a spouse who was NOT the sole beneficiary of an IRA, you’ll need to transfer your portion of the assets into a new IRA set up and formally named as an inherited IRA. (For example: [Name of Deceased Owner] for the benefit of [Your Name].) You may not make additional contributions to this new, inherited IRA.

Inherited IRA Distribution Rules

In December 2019, the Secure Act was signed into law. Under this law, most IRA beneficiaries must use an inherited IRA within 10 years of the account owner’s death. You can choose to withdraw all of the money at once, or you can withdraw multiple distributions over time, as long as the account is empty by the end of 10 years.

Exceptions to the 10-year rule on inherited IRAs apply to:

- Spouses who inherit an IRA: As stated above, surviving spouses can treat an inherited account as if it was their own. There are no mandatory withdrawals for Roth IRAs, and for traditional IRAs, required distributions start when you turn 72.

- A minor child: Minor children must start distributions based on their life expectancy once they reach the “age of maturity” (usually 18). At that point, they’ll have 10 years to withdraw the entire account.

- Chronically ill or disabled beneficiaries: They can stretch the IRA distributions out over their lifetime.

- Beneficiaries who are not more than 10 years younger than the account owner: Withdrawals can be stretched over their lifetime.

If The Beneficiary is a Trust

What if the IRA beneficiary is not an individual, but a trust? Then the successor trustee must determine if the trust will be holding assets for a beneficiary for a length of time, such as for a special needs or minor beneficiary. If so, then the IRS considers the trust to be an “accumulation trust” and distributions will be taxed at the higher tax rates for trusts.

If the trust will NOT be holding assets over time and will be distributing them outright to the beneficiaries, AND the trust includes an “in-kind distribution clause”, then the IRS considers this trust to be a “conduit trust”. In this situation, you can pass the IRA funds directly to the trust beneficiary (or beneficiaries) who can then handle the inherited IRA funds as an individual non-spouse.

3 Factors to Consider with an Inherited IRA

Here are three factors to consider when it comes to inherited IRAs:

- The 5-year rule: If you inherited a Roth IRA that was less than 5 years old at the original owner’s death, you’ll owe taxes on the earnings you withdraw.

- Required Minimum Distributions (RMDs) on Traditional IRAs: If you inherit a traditional IRA, you need to figure out if the original account owner had already taken their RMD in the year of their death. If not, the account beneficiary must do so.

- Tax Impact of Lump-Sum Withdrawal: While it may be tempting to cash out an inherited IRA by taking a lump-sum distribution, withdrawals from traditional IRAs are taxable as income and may push you into a higher income tax bracket.

If you inherit an IRA, you may wish to consult an experienced tax professional to find the best strategy for your personal circumstances. If you have any questions about what to do with an inherited IRA or would like a referral to a tax professional, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.