What’s the Independent Administration of Estates Act?

If you’ve been appointed as Personal Representative in a probate matter, it’s important to understand what powers you have under the Independent Administration of Estates Act (IAEA). Differentiating between full and limited authority under IAEA will help you determine how to deal with any real property included in the estate.

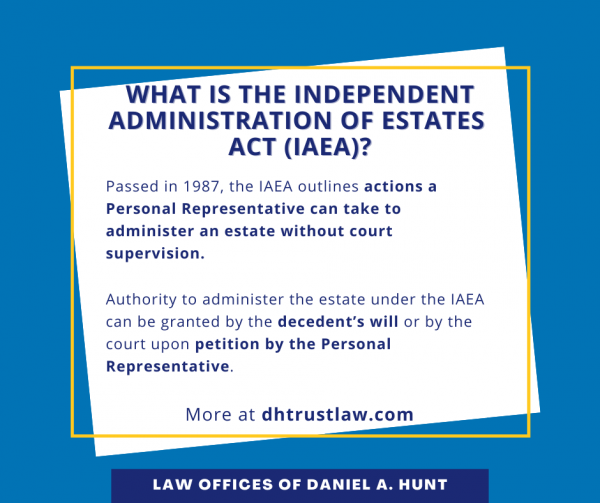

What is the Independent Administration of Estates Act (IAEA)?

Passed in 1987, the Independent Administration of Estates Act (IAEA) outlines actions a Personal Representative can take to administer an estate without court supervision. Authority to administer the estate under the IAEA can be granted by:

- The decedent’s will; or

- The court upon petition by the Personal Representative.

Often when the Personal Representative files their opening petition at the beginning of the probate, their petition includes a request for full authority under the IAEA. However, you can file a petition requesting these powers at any time during the probate process.

The court may deny IAEA powers if:

- An interested party object to the petition with “good cause”; or

- The decedent created a will that specifically denies the executor these powers.

If the petition is denied, the court may grant the Personal Representative limited authority under the IAEA.

Full Authority vs. Limited Authority

Full authority granted under the IAEA rules allows you as the Personal Representative to do any of the following real estate-related tasks without court supervision (as outlined in the California Probate Code sections 10550-10564), once you give a proposed notice of the action to the heirs/beneficiaries (as outlined in the California Probate Code sections 10511-10517):

- Sell or exchange real property

- Grant an option to purchase real property

- Act on claims against the estate

- Pay taxes, assessments, and expenses incurred in the administration of the estate

If the court only grants you limited authority, all of the actions listed above require court supervision and approval. Court approval may also be required if you or your attorney are the principal performing any of these tasks. For example, if you are the buyer purchasing the decedent’s home, this action may require court approval.

What is a Notice of Proposed Action?

Even when granted full authority under the IAEA, a Personal Representative does not have unlimited power. You still need to seek permission to sell real property with a document called “Notice of Proposed Action.” This notice should be sent to any person or entity who has an interest in the proposed sale or may be affected by it. The exception would be if that person had waived their right to this notice in writing.

According to California Probate Code section 10581, the notice should be sent to:

- Everyone named in the decedent’s will;

- Each known heir if the decedent died intestate (without a will);

- Any other interested persons requesting notice, like creditors or beneficiaries of a trust; and

- The Attorney General, if any portion of the property is to go to the State.

The Notice of Proposed Action must include all of the following information:

- Your name and mailing address;

- The name and telephone number of the person to contact for additional information;

- A reasonably specific description of the action to be taken, including a description of the property and the terms of the sale, exchange, or granting of an option to purchase property (price and amount or method of calculating any brokerage commissions); and

- The date on or after which the proposed action will occur.

How to Send a Notice of Proposed Action

At least 15 days before the date of the proposed action, the Notice of Proposed Action must be mailed or personally delivered to everyone entitled to receive it. If you’re not sure how to contact any of these individuals, mail the notice to their last known address. Send the notices via first class mail.

Advantages of Using IAEA Powers

While a personal representative who has been granted full authority to administer the estate under the IAEA is not required to do so, there are advantages to using these powers. Real estate sales under the IAEA are faster than court-supervised sales, which allows you to pay estate expenses as they occur.

If you need help seeking court authority under the IAEA or any other aspect of estate administration, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.