What Does a Surviving Spouse Inherit?

When a spouse dies, what does a surviving spouse inherit? As with most legal questions, the answer is: “It depends”! If you’re a surviving spouse trying to figure out how much of your deceased spouse’s property you stand to inherit, there are numerous factors to consider. You should seek the advice of an experienced trust and estate attorney.

What does a surviving spouse inherit in California?

In the community property state of California, the surviving spouse is entitled to at least one-half of any community and quasi-community property accumulated during the marriage. Factors that may impact this percentage include:

- Pre-nuptial or post-nuptial agreement: If the couple signed a pre- or post-nuptial agreement that outlined a different percentage than the standard one-half of community property, this will change the amount the surviving spouse receives.

- Estate planning documents: If the deceased spouse created an estate plan, such as a will or living trust, these documents contain information concerning the distribution of the spouse’s estate upon their death. According to these documents, their spouse may receive more or less than the standard one-half.

- Beneficiaries on life insurance policies, retirement plans, and/or payable on death (POD) accounts: Retirement accounts, life insurance policies, and payable on death accounts (aka “transfer on death” accounts) all require the owner to list a preferred beneficiary. This is called a “beneficiary designation”. When the owner dies, these assets are transferred directly to the listed beneficiary.

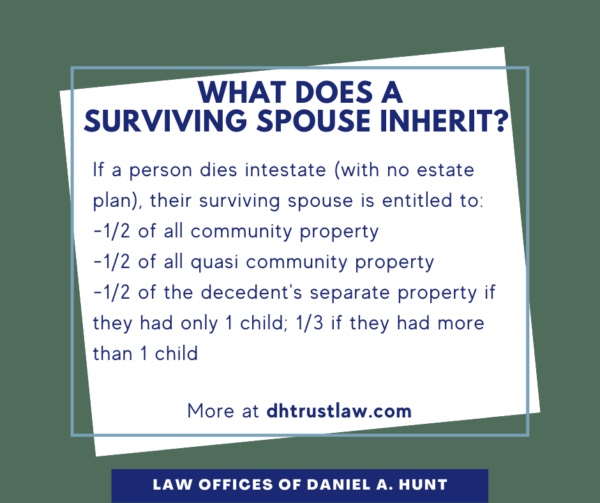

What If a Spouse Dies Intestate?

When a person dies without an estate plan in place, this is called dying intestate. Their assets may need to be distributed by the California probate court according to the California laws of intestate succession.

Under these intestacy laws, the surviving spouse is entitled to one-half of all community property. Community property is any asset acquired by a couple while married except an inheritance or gift.

A surviving spouse is also entitled to one-half of all quasi-community property – any asset that was acquired by one spouse in another state that would have been community property had it been acquired in California.

Finally, the surviving spouse may be entitled to all of the deceased spouse’s separate property if the spouse had no other living relatives. If they only have limited living relatives, the surviving spouse may also be entitled to part of the separate property in the probate estate. For example, if the decedent only had one child, the surviving spouse would get 1/2 of the separate property. If the decedent had more than one child, the surviving spouse would get 1/3 of the separate property. For help navigating the estate administration, consult a probate lawyer for legal advice.

Who Inherits a Spouse’s Real Estate?

One question many surviving spouses may have is who inherits their spouse’s real estate. Check the title on the deed. Here are a few common ways title may be held:

- The decedent, as trustee of their trust: If the house title is held in a trust the decedent created alone, then the property will be distributed as outlined in the decedent’s estate plan. If they created a trust with their spouse, then the surviving spouse will take over as trustee and continue living in the house.

- Joint Tenancy with right of survivorship: If the house is titled as “joint tenants with right of survivorship”, then the surviving spouse will inherit the house without needing to go to probate court.

- The decedent’s name alone, as separate property: If the house is titled in the decedent’s name only, it is considered to be their separate property. Their surviving spouse may be entitled to inherit part of it, but probate may be necessary.

Determining what a surviving spouse is entitled to after their partner passes can be complex. Be sure to consult with an experienced estate planning attorney for legal advice.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.