What Assets are Subject to Probate in California?

Will your entire estate, including all of your funds and property, automatically go through the probate process after you pass away? No, despite some popular misconceptions. Deceased individuals leave behind many different types of assets when they pass away, but not all of them are subject to California’s probate laws.

The probate court only has the legal authority to distribute probate property, that is, property owned solely by the deceased individual. Some assets, such as property owned jointly, are not subject to the probate court. Non-probate property can pass to another person outside of the probate court. If you are interested in avoiding the probate process, an estate planning lawyer can help you understand your options, such as creating a trust-based estate plan.

Assets Subject to the California Probate Court

Probate assets include any personal property or real estate that the decedent owned in their name before passing. Nearly any type of asset can be a probate asset, including a home, car, vacation residence, boat, art, furniture, or household goods.

Probate assets can also include intangible assets, such as stocks, money in a checking or savings account, interest in a business, and other similar items. The following types of assets are typically considered part of the decedent’s probate estate. Intellectual property rights, such as a trademark, copyright, or patent, can also be considered probate assets. As a result, these types of assets are typically subject to the probate process in California:

- All of the decedent’s separate property, which includes assets in the decedent’s name alone. The decedent’s separate property includes property acquired outside of marriage or inherited during the marriage

- One-half of the decedent’s community property, which is typically property acquired during the marriage

- The decedent’s portion or share of a property when the asset is titled as a “tenant in common” with other people

Assets Not Subject to California Probate

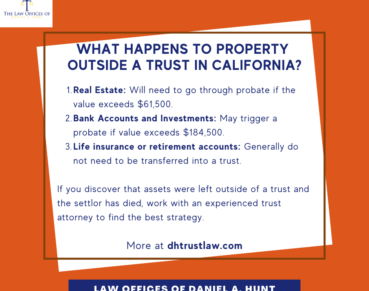

Property that is not owned individually by a decedent can be considered a non-probate asset by operation of law. For example, real estate is a common non-probate asset. Many times people hold real estate jointly with the right to survivorship. In this situation, when one owner passes away, their interest will automatically pass to the surviving owner or owners upon their death. This transfer of ownership happens entirely outside of the probate process. Many spouses own their property jointly with the right of survivorship.

When one spouse passes away, the other spouse will automatically receive their ownership share and become the sole owner of the property. The surviving spouse does not need to go through the probate process. They automatically own the house when the other spouse passes away. In addition to property owned in joint tenancy, the following types of properties will pass outside of the probate process:

- Assets in a trust: One of the key benefits of creating a living trust is to avoid the probate process. If you transfer your property into a trust, it will be considered non-probate property. Since the trust owns your property, the probate court will not have any authority to manage your property and distribute it to your beneficiaries. Instead, you can state how you like your property to be distributed after your death in the trust agreement.

- Retirement Accounts: Most retirement accounts, including 401ks and IRAs, have a beneficiary designation. When you create the account, you can appoint someone to be your beneficiary. When you pass away, the ownership of the account will transfer automatically to your beneficiary. These types of retirement accounts are excluded from the probate process. We recommend choosing an alternate beneficiary as well as a primary beneficiary.

- Trustee accounts: Assets in a bank or credit union can be excluded from the probate process when the deceased individual was named as a trustee, guardian, or conservator for another person.

- POD Accounts: Assets with a “pay on death” or POD designation are often called POD accounts. Securities accounts registered as “transfer on death” or TOD accounts are also excluded from the probate process.

- Life Estate: Any life estate interest owned by the decedent will terminate at their death and will not be subject to probate. For example, if the decedent had a life estate interest in a family-owned property, they would have the right to live in the property until death. Upon their death, the ownership interest would terminate and not be distributed through the probate process.

Conclusion

This was a general overview of what types of assets are considered probated and non-probated assets. However, each decedent’s estate is unique, and there is no substitute for the advice and counsel of an experienced Sacramento probate lawyer.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.