What is Undue Influence in California?

Family members sometimes believe that someone exerted “undue influence” over their loved one before they passed away. Often this involved convincing an elderly person to make gifts or change their estate plan to benefit the elder abuser. In cases like these, the family members may wish to contest the trust or will after the loved one passes away. How can you know if undue influence took place? First, you need to understand what constitutes undue influence in California.

What is Undue Influence in California?

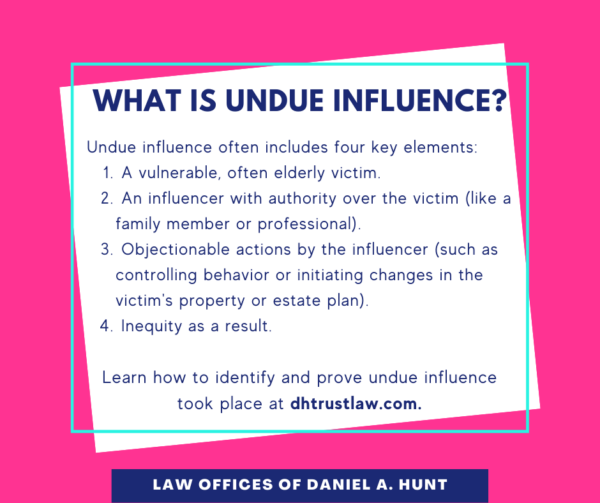

The California Welfare and Institutions Code defines undue influence as “excessive persuasion that causes another person to act or refrain from acting by overcoming that person’s free will and results in inequity.” California law outlines four key components of undue influence:

Element #1: The Victim’s Vulnerability

Victims of undue influence are often vulnerable in some way that renders them susceptible to undue influence. Evidence of the victim’s vulnerability may include some or all of the following:

- Illness or injury

- Mental or physical incapacity

- Disability

- Advanced age

- Education (such as illiteracy or speaking English as a second language)

- Impaired cognitive function (such as advanced Alzheimer’s disease)

- Emotional distress (such as grief after the passing of a longtime spouse or partner)

- Isolation or dependency

Element #2: The Influencer’s Authority

In undue influence cases, the influencer is a person who holds a special position of authority and power over the elderly person. Here are a few examples:

- A family member

- A professional fiduciary

- A care provider

- A healthcare professional

- A legal professional

- A spiritual adviser

While the person exerting undue influence may occasionally be a stranger, most people who exert undue influence are well-known to the victim and are often family members.

Element #3: The Influencer’s Questionable Actions

With undue influence, the influencer uses objectionable tactics to get what they want from the vulnerable elderly person. Tactics used by the influencer may include:

- Controlling the necessities of life, such as food, water, sleep, and medication.

- Controlling the victim’s interactions with others and access to information.

- Using affection, intimidation, and/or coercion.

- Initiating changes in the elderly person’s assets and property, especially when done in a hasty or secretive manner or at an inappropriate time or place, and claiming expertise in executing these changes.

Element #4: Inequity as a Result

With undue influence, the end result is a situation that is unequal. Evidence of inequity may include:

- Negative economic consequences to the victim

- A major change from the victim’s prior intent or manner of conduct

- A gap between the value of services rendered to the price paid for the services

- A change that is inappropriate in light of the length and nature of the victim’s relationship with the influencer

Note that an inequitable result alone is not enough to prove undue influence occurred. Several of the elements of undue influence must be substantiated in order to prove that undue influence took place.

How to Prove Undue Influence Occurred

When it comes to proving to a judge that undue influence occurred, it can be helpful to demonstrate the vulnerability of the victim due to a weakened mental state. This usually involves asking a medical professional or psychiatrist to testify that the victim was not “of a sound mind” when they made the financial or legal choices in question.

Another critical factor to demonstrate is the influencer’s apparent authority by showing that the abuser had an authoritative relationship and special access to the victim. If the abuser has frequent private access to the victim, such as a live-in caregiver, a worker at a caregiving facility, or a professional who often visits with the victim, this can show an authoritative relationship and potential for abuse.

Examples of Undue Influence

A successful case should also demonstrate that the influencer used inappropriate tactics to effect a change for their own benefit. Witnesses to the manipulative or controlling behavior and evidence of changes that are inconsistent with the elderly person’s previous estate plan can help to establish a case of undue influence.

Undue influence can often step into a large gray area in the law. It can be difficult to determine what would and wouldn’t be considered undue influence. Here are two examples to show the difference.

Example #1: Katrina and a Probable Case of Undue Influence

Katrina’s 92-year-old father was in the late stages of dementia and was being cared for by a 25-year-old female live-in caregiver. The caregiver had private access to the victim and controlled all of his necessities of life, including his medications. She often made excuses for reasons why Katrina couldn’t come to visit him and several witnesses observed these controlling behaviors.

After Katrina’s father passed away, the caregiver produced a new typewritten amendment to her father’s trust. While supposedly signed by her father, the signature looked unfamiliar to Katrina and the document was never notarized or reviewed by an attorney. The amendment left her father’s house to the caregiver instead of to Katrina and her siblings as indicated in his original trust.

A scenario like Katrina’s would have a higher likelihood of a successful trust contest due to her father’s vulnerable state, the caregiver’s position of authority, her controlling behavior, and the unequal outcome of the suspicious new amendment.

Example #2: Sarah and an Unlikely Case for Undue Influence

Sarah is 65 years old, in good health, and very independent. She has two adult children: one son who is a millionaire CEO and one who is disabled and lives with Sarah but does not act as her caregiver.

One day, Sarah’s disabled son asks if he can continue living in the house after she passes away. Because of his greater need compared with his successful CEO brother, Sarah decides to visit an estate attorney and draft a trust that leaves her house to her disabled son as part of his inheritance.

While the millionaire son may feel this distribution is unfair, this scenario is not a great candidate for proving a case of undue influence. Sarah is not in a vulnerable state, the disabled son is not in a position of authority over her, and he did not manipulate her with his actions to get the desired outcome.

If you’re wondering if undue influence took place, seek the advice of an experienced trust and estate litigation attorney. If you have any questions about undue influence in California, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.