Understanding Probate Bonds

Understanding probate bonds is an important part of the probate process. If you’re involved in a California probate, you may have heard that some executors or administrators are required to set up a probate bond. But what is a probate bond, when is it required, and how much does it cost?

What is a Probate Bond?

A probate insurance bond (also known as a fiduciary bond) is a type of surety bond held by the personal representative for the estate to insure them as they perform all of their fiduciary duties as outlined in the California Probate Code.

A probate bond protects the estate’s beneficiaries and/or heirs from any mistakes (intentional or unintentional) the personal representative of the estate might make in their role. Unfortunately, some executors or administrators fail to observe their fiduciary duties, which results in monetary damages for the heirs or beneficiaries. If the estate beneficiaries receive a judgment against the personal representative, the beneficiaries can then make a claim against the bond for compensation.

If the claim is valid, the surety bond company that issued the bond will initially provide financial compensation to the beneficiaries. However, the personal representative will then be responsible for reimbursing the bond company for any payments they had to make.

Who Needs a Probate Bond?

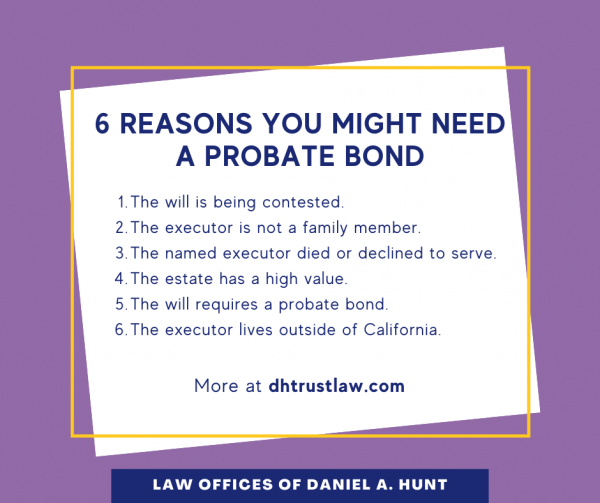

Here are some common reasons why a bond might be required:

- The decedent’s will is being contested by family members or another party.

- The executor/administrator is not a family member of the decedent.

- The original executor named in the will has died or declined to serve, causing another person to be appointed in this role.

- The estate has a high value. The larger the estate, the higher the risk to the beneficiaries if the executor mismanages the administration.

- The will requires them to do so. Some wills have language requiring the executor to obtain a bond. Other wills waive the bond, especially if the testator (will creator) trusts their executor implicitly or if the executor is also the sole estate beneficiary.

- The executor lives outside of the state.

The court does not require a bond in every probate. A judge may waive the bond requirement if:

- They perceive a low risk of executor/administrator misconduct

- There is a provision in the will that waives the bond requirement

- All the heirs are adults and all consent to waiving the bond requirement.

If the judge requires the executor or administrator to take out a bond, they must do so before the court will issue a necessary document called “Order and Letters”. The “Letters” prove the personal representative’s authority to collect assets from financial institutions, sell real property, and generally act on behalf of the estate.

Cost of a Probate Bond

Many factors pertaining to the executor or administrator affect the cost of obtaining a probate bond, including their:

- Credit score (High credit score = lower risk)

- Relationship to the deceased (Family member = lower risk than an unrelated person)

- Occupation (Greater financial security = lower risk)

- Personal Assets (Greater financial security = lower risk)

- Previous bond claim history (Clean bond record = lower risk)

- Criminal record (Clean criminal record = lower risk)

- Experience level (An experienced estate executor or administrator = lower risk)

The higher the risk level of the principal (insured person), the higher the cost of the bond. The cost of the bond is also influenced by the size of the estate. Fortunately, the principal is only required to pay a percentage of the total bond in order to be bonded, not the full amount. In Sacramento, a typical range for a bond per year is $1,000 – $3,000.

If you need to secure a probate bond, we recommend Bond Services. Our office has worked with them for many years with positive results.

If you have any questions about securing a probate bond, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.