What to Do When the Trustee Is Not Paying the Beneficiaries

Trust funds are designed to provide financial security to beneficiaries, but issues can arise when the successor trustee responsible for managing and distributing the assets fails to fulfill their obligations. If you’re a beneficiary of a trust who is struggling to get trust fund distributions, this guide will explain what to do when the trustee is not paying the beneficiaries.

Understanding Your Rights as a Beneficiary

As a beneficiary of a trust, you have a legal right to receive distributions according to the terms of the trust document. Trustees have a fiduciary duty to act in the best interests of the beneficiaries, manage trust assets prudently, and adhere to the trust’s provisions.

If a trustee fails to fulfill their duties, beneficiaries have several legal remedies to ensure they receive their distributions.

Valid Reasons to Delay Distribution

First, it’s important to ascertain if there is a valid reason the trustee may be delaying distributing assets to beneficiaries. Valid reasons include:

- A Discretionary Distribution Scheme: The trust may grant the trustee authority to decide the timing and amount of distributions to the beneficiaries.

- Staggered Distribution Scheme: The trust may direct the trustee to distribute trust assets at certain intervals over time instead of making an outright, immediate distribution.

- Conditions Not Met: If the trust terms set forth certain conditions that beneficiaries must meet before receiving their inheritances, distributions may be delayed until those conditions are met. For example: some beneficiaries cannot access their inheritance until they reach a certain age or milestone like college graduation.

- Trustee Discretion: If the trustee has reason to believe the beneficiary will squander the inheritance due to substance abuse, serious mental illness, or a lack of capacity.

Assuming that none of the previous conditions apply, let’s look at some common reasons trustees fail to pay beneficiaries.

Common Reasons Trustees Fail to Pay Beneficiaries

Assuming that none of the previous valid conditions apply, let’s examine some common reasons a trustee might refuse to pay a beneficiary.

- Mismanagement of Assets: The trustee might not be managing the trust’s assets properly, leading to a lack of funds for distributions.

- Breach of Fiduciary Duty: The trustee might be misusing trust assets or acting in their own interests rather than the beneficiaries’.

- Misunderstanding the Trust’s Terms: The trustee might misinterpret the trust’s terms, resulting in incorrect or missed distributions. Typically, this happens when the trustee tries to administer the trust alone without the help of an experienced trust attorney.

- Negligence: The trustee might simply neglect their duties, causing delays or failures in distributions.

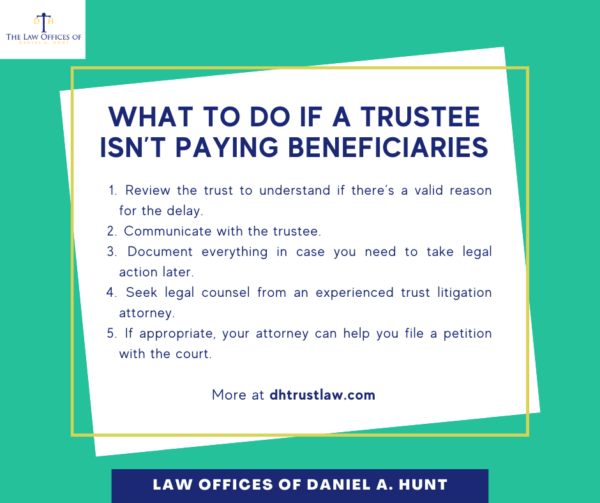

What To Do If the Trustee Is Not Paying

If you’re a beneficiary and believe the trustee refuses to pay what you’re entitled to, follow these steps:

Step 1: Review the Trust Document

Start by thoroughly reviewing the trust document to understand your rights and the trustee’s responsibilities. Look for specific distribution provisions, timelines, and other relevant terms. This will help you determine if the trustee is violating the trust’s terms or if there’s another reason for the delay.

Step 2: Communicate with the Trustee

If you’re comfortable, reach out to the trustee to discuss your concerns. Explain that you’re not receiving distributions and ask for clarification on why this is happening. Sometimes, a simple misunderstanding or miscommunication can be resolved through open dialogue.

Step 3: Document Everything

If communication with the trustee doesn’t resolve the issue, start documenting all interactions and correspondence. This documentation can be crucial if you need to take legal action later. Keep a record of emails, letters, phone calls, and any other relevant information.

Step 4: Seek Legal Advice

If the trustee continues to withhold distributions, or if you suspect a breach of fiduciary duty, it’s time to contact an trust litigation attorney and seek legal advice. A trust lawyer can help you understand your rights, assess the trustee’s conduct, and guide you through the legal process.

Step 5: File a Petition in Court

If your attorney confirms that the trustee is not fulfilling their duties, they can help you file a petition in court. The court has the authority to:

- Order the trustee to make distributions according to the trust’s terms.

- Remove the trustee for breach of fiduciary duty or other misconduct.

- Appoint a new trustee to ensure the trust is managed properly.

- Order an accounting of the trust’s assets to identify any mismanagement or misuse.

Dealing with a trustee who is not paying beneficiaries can be frustrating, but you have legal options to ensure you receive your entitled distributions. Start by reviewing the trust document and communicating with the trustee. If the issue persists, document everything and seek legal advice from a trust litigator. With proper guidance and action, you can protect your rights as a beneficiary and ensure the trust is managed appropriately.

If you have any questions about what to do when the trustee Is not paying the beneficiaries, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.