What Happens If a Trustee Doesn’t Follow the Trust?

When a person establishes a trust, they include directions for how they want their assets to be distributed upon their death. They also select a trustee to carry out their wishes after they die. But what happens if a trustee doesn’t follow the trust?

What is a trustee’s duty to administer the trust?

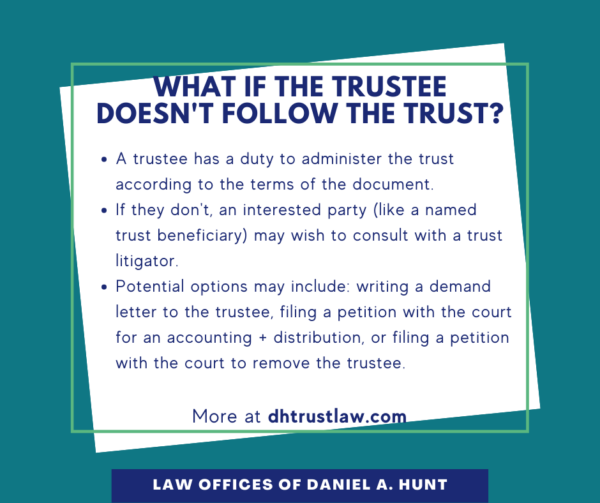

All of a trustee’s duties are outlined in the California Probate Code. Section 16000 outlines a trustee’s “duty to administer the trust”. This statute requires a trustee to administer a trust according to law and in accordance with the terms of the trust agreement. No matter how good the trustee’s intentions are, they are not free to administer the trust in any other manner.

Neglecting this duty to administer the trust is sometimes called a “breach of trust” or a “breach of fiduciary duty”.

What can you do if the trustee fails to follow the trust?

If a trustee fails to follow the trust as written, you may be able to take legal action against them if you have legal standing to do so. To sue a trustee, you must be an “interested party” which is usually a named beneficiary of the trust. Beneficiaries may wish to try one of more of the following options:

- Contact an experienced trust litigation attorney. An experienced attorney can review the trust and any information the trustee has sent you, and counsel you on the best course of action. Often the attorney will start by writing a letter to the trustee requesting a trust accounting and any other information to which you are entitled.

- File a petition with the Probate Court for a trust accounting and distribution. This petition asks the court to compel the trustee to provide a full accounting of their actions and to distribute the trust assets to the beneficiaries within a specific time frame.

- File a petition with the Probate Court to remove the trustee. This petition asks the court to remove the trustee from their position and replace them with a new one. The court may also order the trustee to return any misappropriated funds if the evidence demonstrates this has occurred.

Who must prove a breach of trust occurred?

If a beneficiary chooses to file a petition with the court to remove a trustee, the burden of proof will rest on them as the petitioner to prove that the trustee has committed a breach. This means the beneficiary will have to present sufficient evidence to show the judge that the trustee has failed to discharge a duty owed to the trust beneficiaries and that that breach caused harm.

What type of evidence is needed to sue a trustee?

Often, a trust accounting alone can provide enough evidence to prove or disprove a breach of trust. But if the accounting alone does not, the petitioner and the trustee (or “respondent”) can request additional documents and information from each other as well as other third parties during a process called “discovery”.

The type of evidence that will be necessary differs based on the situation. A few examples of key evidence needed to prove your case might include bank statements, escrow and closing documents associated with a real estate sale or purchase, and/or investment account statements.

What if the petition is denied?

If you cannot provide enough evidence to prove that a breach of trust occurred, the judge may deny your petition and may even require you to pay the respondent’s attorney fees. While you’ll never be guaranteed to win in court, an experienced trust litigator can help you understand the strength of your case and all of the options available to you.

If you have any questions about what happens if a trustee doesn’t follow the trust, feel free to reach out to our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.