How Long Does a Trustee Have to Distribute Assets?

How long does a trustee have to distribute assets? The answer depends on a number of factors. According to the California probate code, all trustees have a duty to administer the trust according to the terms of the trust instrument.

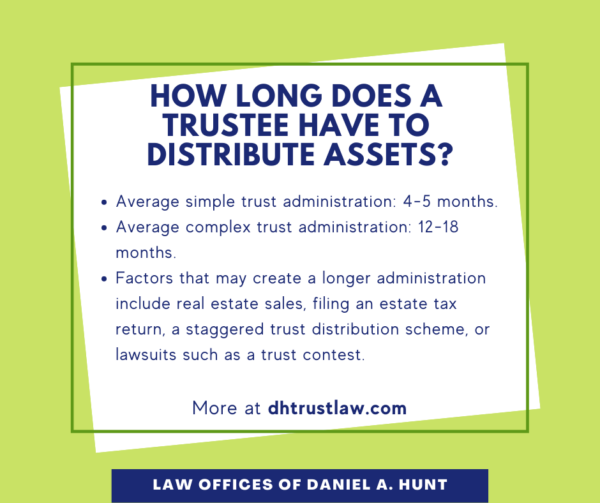

In general, a typical revocable trust with an outright distribution provision can be fully distributed within 12-18 months. If there are no complicating factors, the average length of time to distribute assets may be as little as 4-5 months.

What factors may extend a trust administration?

While a typical California trust administration takes 12-18 months, extenuating circumstances may cause it to take longer. To start, here are a few situations that may cause a trust administration to take longer than usual:

- Selling real estate: This is especially true if the real property is difficult to sell, needs a lot of work before it can be sold, or if there are multiple properties to sell.

- Filing an estate tax return: Filing an estate tax return may delay trust distributions, but they are only required in very large multi-million dollar estates.

- Staggered distributions: If the trust has a staggered distribution scheme, such as annual distributions to a beneficiary over a period of time, then the trust will need to remain open for a number of years. But most revocable trusts include an outright distribution after the settlor’s death.

- Lawsuits such as a trust challenge: If the trustee is sued, such as when a family member challenges the trust, this may cause a considerable delay before the estate assets can be distributed.

What information is a beneficiary entitled to receive?

While complicating factors may extend the length of a trust administration, there is certain information that the beneficiaries are entitled to receive during this process.

- Notice of Administration: Under California Probate Code 16061.7, the successor trustee is required to send notice of trust administration to each trust beneficiary and heir no more than 60 days after the death of the settlor.

- A copy of the trust: Under 16061.5, the trustee must also provide a “true and complete copy” of the trust document.

- Updates and accounting: The trustee has a Duty to Report Information and Account to Beneficiaries. That means the trustee should provide regular updates regarding the trust administration status. The beneficiaries are also entitled to an annual accounting of the trustee’s actions.

If you are a beneficiary and have not received any of the information you are legally entitled to receive, you may wish to seek the representation of an experienced trust attorney to fight for your rights.

What if the administration lasts longer than 18 months?

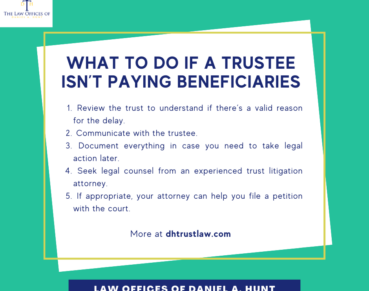

Let’s say it’s been eighteen months or more since the trustor passed away. You’re not aware of any extenuating circumstances, but the trustee is still nowhere close to distributing assets to beneficiaries. Maybe you haven’t received information to which you’re entitled. Maybe you even suspect the trustee of wrongdoing involving trust funds. What can you do?

Your first step should be to collect as much information as you can, including a copy of the decedent’s revocable living trust, any communications you have had with the trustee, and any financial/accounting information you have received about the trust.

Next, seek the advice of an experienced trust litigation attorney who can provide sound legal counsel. Often your attorney’s first action will be sending a demand letter for information to the trustee or the attorney who is representing them (if they have hired legal counsel). A demand letter may provide sufficient motivation for them to expedite the trust administration process and/or provide any information they have previously failed to provide.

If not, your attorney can counsel you on appropriate next steps which may include mediation or even a court trial if the trustee has breached their duties, such as stealing trust funds or failing to administer the trust in a timely manner. You may wish to seek a court order to distribute funds, reimbursement for stolen trust funds, and/or replacement of the trustee, depending on the circumstances.

If you have any questions about how long a trustee has to distribute a trust, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.