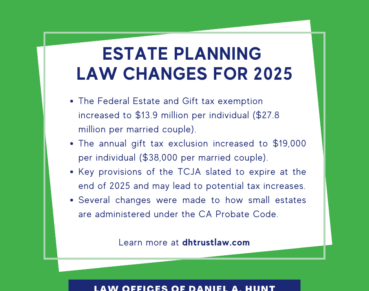

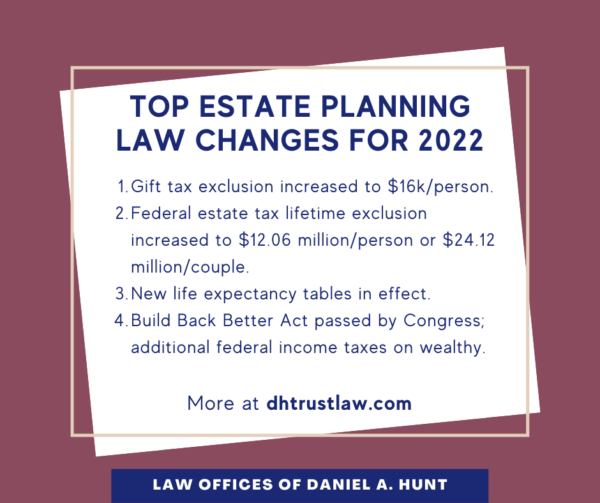

Top Estate Planning Law Changes for 2022

At the Law Offices of Daniel Hunt, we want all of our clients to be empowered to make optimal decisions for their estate. That’s why we inform our clients of key changes in trust & estate planning law every year. Here are the top estate planning law changes for 2022!

Gift Tax Exclusion

The gift tax exclusion amount in 2022 has increased to $16,000 per individual or $32,000 per married couple splitting their gifts. In other words, you can give up to $16,000 to as many people as you wish without those gifts counting against your lifetime exemption.

Federal Estate Tax Exemption

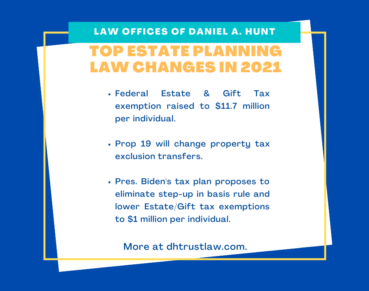

The Federal Estate and Gift Tax exemption has once again increased to $12.06 million per individual (or $24.12 million for a married couple), up from $11.7 million in 2021. This means that you can give away $12.06 million of assets over the course of your life without owing any Federal Estate tax.

The IRS and Treasury have clarified that the government will not “claw back” gifts given between 2018-2025 that exceed $5 million, with respect to someone who dies in or after 2026.

However, under the 2012 Act, the $12.06 million exemption will end on December 31, 2025, and go down to $5 million. So if you have a large estate, be sure to make an appointment with one of our attorneys to discuss how this may affect you!

Required Minimum Distributions

On January 1, 2022, new life expectancy tables went into effect. These tables are used for determining required minimum distributions (RMDs) from IRAs and qualified retirement plans.

The new tables affect:

- Traditional IRA owners who have reached their Required Beginning Date for taking RMDs

- Qualified retirement plan participants who have reached their Required Beginning Date for taking RMDs

- Beneficiaries of an inherited IRA or qualified retirement plan

Check with your plan administrator or financial advisor regarding how to compute your RMDs for the calendar year 2022 using the new tables.

Update on Build Back Better Act

On November 19, 2021, the U.S. House of Representatives passed the Build Back Better Act. As of the date of writing, the Senate has not yet voted on the Act.

Here are two significant changes included in the House-passed version of the Act:

- A new 5% additional federal income tax on modified adjusted gross income (MAGI) over $10 million for unmarried individuals and married individuals filing jointly or on MAGI over $200,000 for estates and non-grantor trusts.

- A new 3% federal income tax (after applying the 5% additional tax) on MAGI over $25 million for unmarried individuals and married individuals filing jointly or to MAGI over $500,000 for estates and non-grantor trusts.

The following taxes remain unchanged in the House-passed version of the Act:

- The top 37% federal income tax rate on ordinary income

- The top 20% federal income tax rate on long-term capital gains or qualified dividends

- The top 40% federal transfer tax rate

- The federal transfer tax exclusion amounts

- The use of grantor trusts for estate planning purposes

Congress continues to negotiate this legislation. Be sure to work with an experienced estate planning attorney and CPA for advice as estate and tax laws continue to evolve.

Here are a few items that stayed the same in 2022:

Probate Cut-Off

If your estate is worth $184,500 or less in 2022, you can avoid a California probate (up from $166,250). If your estate is worth more than that amount, a probate may be triggered upon your passing unless you have created a revocable living trust and transferred your assets properly into it.

Federal Tax Rates

The highest federal estate tax, gift tax, and GST tax rate remain at 40%. The highest federal income tax rate for estates and non-grantor trusts is 37%. This tax rate applies to taxable income over $13,450 earned by an estate or non-grantor trust during its administration period.

Step-Up In Basis

Although there were proposals in Congress last year to change the “step-up in basis”, Congress did not pass those proposals. So in 2022, the income tax basis of property acquired from a decedent will continue to be adjusted to the fair market value of that property as of the date of the decedent’s death.

Federal Estate Tax Portability

In 2022, surviving spouses continue to be able to transfer their deceased spouse’s unused federal estate tax exclusion amount to themself by filing a federal estate tax return.

If you have any questions about the top estate planning law changes for 2022, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.