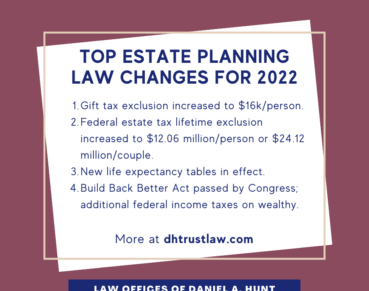

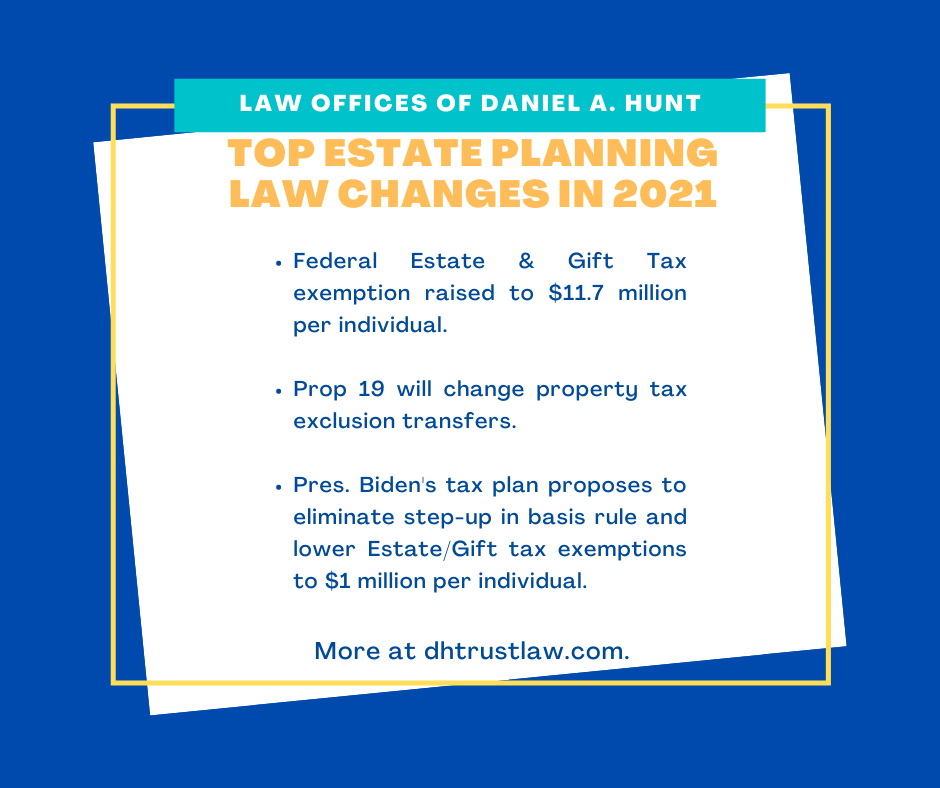

Top Estate Planning Law Changes for 2021

At the Law Offices of Daniel Hunt, we understand that Estate Planning law is always changing and your plans may evolve with it. Here are the most significant legal updates to keep in mind in 2021.

Probate Cut-Off

If your estate is worth $166,250 or less in 2021, you can avoid probate (same as in 2020). If your estate is worth more than that amount, a probate will be triggered upon your passing unless you have created a revocable living trust and transferred your assets properly into it.

Gift Tax Exclusion

The gift tax exclusion amount in 2021 remains at $15,000. That means that you can give up to $15,000 to as many people as you wish without those gifts counting against your lifetime exemption. Speaking of which….

Federal Estate Tax Exemption

The Federal Estate and Gift Tax exemption has once again increased to $11.7 million per individual (or $23.4 million for a married couple), up from $11.58 million in 2020. This means that you can give away $11.7 million of assets over the course of your life without owing any Federal Estate tax.

But these numbers could soon be very different under the new presidential administration.

Biden Tax Proposals

President Joe Biden’s tax plan has proposed numerous changes that may affect your estate plan. Here are two of the biggest proposed changes:

1. Returning the estate tax and gift tax exemptions to 2009 levels (45% estate tax rate for estates over $3.5 million and $1 million for gift tax). As mentioned above, in 2021, as long as your estate is worth less than $11.7 million for an individual or $23.4 million for a married couple when you die, no estate tax will be owed upon your death. You can also give away up to $15 thousand to as many individuals as you’d like without owing any gift tax.

Under President Biden’s proposed plan, those numbers would return to much lower levels last seen in 2009. The estate tax exemption rate would be $3.5 million, making estate tax once again an important estate planning consideration for a much wider audience than it is today. The gift tax would be $1 million per person.

2. Eliminating the step-up in basis. The current step-up in basis rule allows for your assets tax basis to step-up to the current fair market value as of the date of your passing. Currently, if you own an asset that has appreciated greatly in value (for example, a valuable piece of real property), it makes far more sense to wait until your death to pass it on to your heirs. That’s because the step-up in basis rule prevents them from needing to pay Capital Gains tax on the inherited property.

Repealing the step-up in basis would place a heavier tax burden on trust beneficiaries and estate heirs. If the step-up in basis rule is eliminated, you may want to alter your gifting strategy. It may be a good idea to meet with one of our attorneys to discuss alternative estate planning techniques.

Time Frame: Biden’s tax plan likely will not be passed into law until January 2022 at the earliest, but once passed, there’s a chance it could be retroactive back to January 2021. If you’re concerned about the effect these changes could have on your estate plan, feel free to contact our office to schedule a trust review appointment.

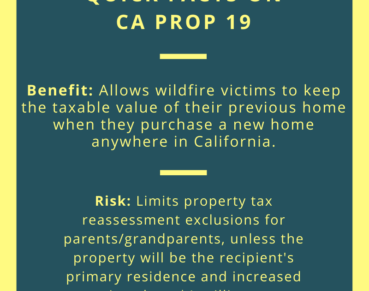

California’s Proposition 19

In the November 2020 election, California voters approved Proposition 19. Prop 19 carries some potential advantages as well as some potential disadvantages.

Starting on April 21, 2021, Prop 19 expands the group of homeowners who qualify for a transfer of their taxable value from their current home to a new property. Let’s take a look at some key changes under Prop 19 that are likely to be advantageous:

- Before: Only homeowners who were over the age of 55 or disabled could move to a new home while keeping the same taxable value as their former residence. Under Prop 19, this benefit will also be extended to wildfire victims.

- Before: The new home had to be in the same county as the old home. Under the new rules, you can move to any county in California.

- Before: The value of the new home had to be equal to or less than that of their new one. Under Prop 19, the value of the new home can be greater than the previous one as long as the increase in value is added to the transferred taxable value of the old home.

Now let’s examine some potential disadvantages to some homeowners. Starting on February 16, 2021, parent-to-child and grandparent-to-child transfers will have a more limited exemption. Here are key points to know:

- Transfers to children or grandchildren outside of the primary residence will be reassessed for property tax. This includes properties that will be used as vacation rentals or as investment properties.

- Exclusions still apply for children/grandchildren who will use the primary residence as their primary residence, up to a value of $1 million.

- If the property value has increased by more than $1 million, a partial reassessment will occur. The $1 million threshold amount will be adjusted for inflation starting in 2023 and every year thereafter.

For more details on how Prop 19 could affect your estate plan, check out our recent blog post on this topic. As always, feel free to contact our office if you’d like to meet with an attorney to discuss how these changes could affect you.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.