Timeline for a California Probate

If you need to open a California Probate after the death of a loved one, you may want to know how long the whole process will take. While the timeline for a typical California Probate varies based on the county, most follow a similar pattern. Here’s an example of a typical California probate timeline.

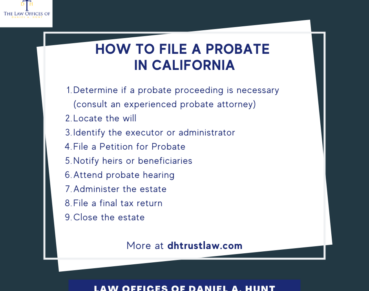

- Meet with a probate attorney to discuss your case. Check out this tutorial on how to prepare for your initial consultation with a probate lawyer.

- File your Probate Petition. About two to three weeks after you’ve hired a probate attorney, they will draft and file a Probate Petition at the Probate Court in the county where the decedent was a resident. You’ll also need to file a document called “Duties and Liabilities of Personal Representative” with the court. This acknowledges that you’ll adhere to your duties in this role.

- Publish and Mail Notices. Immediately after filing your petition, your probate attorney will publish a notice of the initial court hearing date. This notice will appear in a newspaper of generation circulation in the city where the decedent lived. They will also mail a notice to all heirs and any beneficiaries named in their will (if they created one).

- Initial court hearing. You and your probate attorney will attend the initial court hearing at the courthouse where the petition was filed. At your hearing, the judge will sign an “Order for Probate” appointing you as the personal representative of the estate.When will the hearing take place? The time frame depends on the county. For example, in Sacramento County, this hearing typically takes place sixteen to twenty weeks after filing the Probate Petition.

- Bond Issued. If the judge orders you to obtain a bond, you’ll need to secure one. This is basically insurance to protect the estate against the risk of mismanagement by the executor/personal representative.

- Court issues “Letters of Administration”. This document authorizes the personal representative to act on behalf of the estate. If your bond was in place at the hearing or no bond was required, you should receive these at the initial hearing. Once you receive Letters of Administration, you will be able to show them to any financial institutions in order to begin the work of estate administration.

- Collect and inventory assets. After taking an inventory of all estate assets, the personal representative should begin to liquidate personal property (including bank or investment accounts), meaning convert them into cash that can later be distributed to the heirs/beneficiaries.

- Send “Notice to Creditors” to any known creditors. Creditors have 4 months to file any claims with the court. Your probate attorney can help you respond to any existing creditor claims. This can get tricky, as not all claims have the same priority under the California Probate Code. You’ll want an experienced probate attorney to help you handle creditors.

- Sell real property. The personal representative may sell real property assets if necessary, as long as “full authority” has been granted by the court. If the court only granted you “Limited Authority,” then the court must confirm any sale of real estate.

- File “Inventory & Appraisal” (I&A) with the court. A probate referee will complete an appraisal of the estate within ninety days of receiving your letters.

- If the decedent owned real property, file a “Change in Ownership Statement – Death of Real Property Owner” with the County Recorder. This form lets the county know that the owner of a piece of real estate has died and informs them of the new owner. This happens four to six months after filing the petition.

- Pay final income taxes. This happens six to twelve months after filing the petition. Your CPA can help you file a short-year income tax return if appropriate, so you don’t have to wait out the year in order to close the estate.

- File a “Petition for Final Distribution” with the court. This indicates that all debts have been handled, all required steps have been taken, and you are ready to close the estate and distribute the assets. This happens eight to sixteen months after filing the petition.

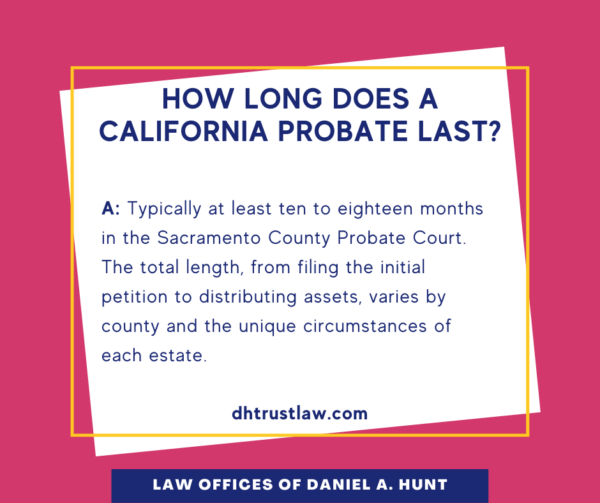

- Final court hearing. You and your probate attorney appear in court. If all goes well, the judge will give you a signed order allowing you to distribute assets to the heirs. This happens ten to eighteen months after filing the initial petition.

The total length of each probate varies based on many variables, including how backlogged the court system is in that particular county at the time. Overall, you can expect to spend at least ten to eighteen months in probate, from filing the original petition to distributing estate assets.

As you can see, California probates are complex and you’ll want an experienced probate attorney coaching you through the process. If you have any questions regarding the timeline of a California probate, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.