Successor Trustee vs. Executor

When it comes to estate planning, the roles of successor trustees and executors are similar but also differ in key ways. Executors and trustees are both responsible for managing and distributing a deceased person’s assets, but their duties, authority, and the contexts in which they operate differ significantly. In this blog post, we’ll explain the differences between successor trustee vs. executor and help you make informed decisions about your estate plan.

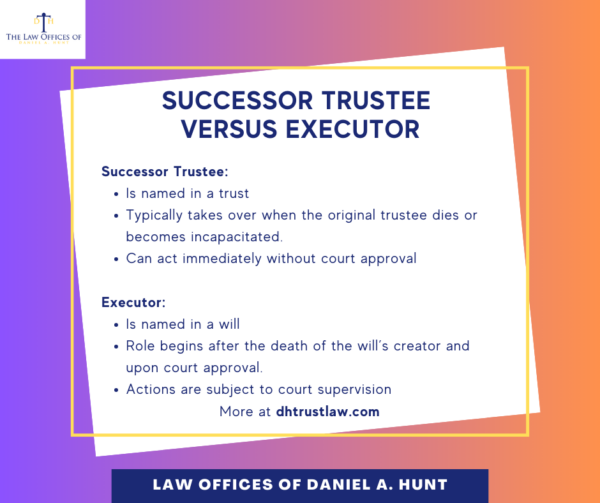

What is a Successor Trustee?

A successor trustee steps in to manage a trust when the original trustee is unable to do so, often due to death or incapacitation. Trusts, especially revocableliving trusts, are designed to hold and manage assets during the grantor’s lifetime and ensure a smooth transition of these assets upon their death.

Key Responsibilities of a Successor Trustee:

- Asset Management: They must prudently manage the trust assets, ensuring they are preserved and grown according to the trust’s terms.

- Administrative Duties: Including paying debts and taxes, maintaining records, and reporting to beneficiaries.

- Distribution: The successor trustee ensures that assets are distributed to the beneficiaries as specified in the trust document.

When a Successor Trustee Steps In:

- Typically, a successor trustee takes over when the original trustee dies or becomes incapacitated.

- Unlike executors, successor trustees can act immediately without court approval, providing a seamless transition.

What is an Executor?

An executor is named in a last will and testament. They are responsible for managing the deceased person’s estate through the California probate process, which is overseen by a court. If the decedent didn’t create a will, the court will appoint a personal representative to settle your estate during the probate proceeding.

Key Responsibilities of an Executor:

- Probate Process: They must file the will with the probate court and manage the probate process, which can be time-consuming and complex.

- Asset Inventory: They compile and safeguard all estate assets, ensuring a complete and accurate inventory.

- Debt and Tax Settlement: Executors are responsible for paying off any outstanding debts and taxes owed by the estate.

- Distribution: After settling debts and taxes, they distribute the remaining assets according to the will’s terms.

When an Executor Steps In:

- The executor’s role begins after the death of the will’s creator and upon court approval.

- Their actions are subject to court supervision, providing oversight but also adding to the complexity and duration of the process.

Key Differences Between Successor Trustee and Executor

Here are some of the differences between a successor trustee and an executor.

Authority and Supervision:

- Successor Trustee: Operates independently without court involvement, allowing for quicker action.

- Executor: Requires court approval and oversight, leading to potential delays.

Power:

- Successor Trustee: Can act while the settlor is still alive if they become incapacitated.

- Executor: Only has the power to act after the testator’s death.

Scope of Responsibilities:

- Successor Trustee: Manages only the assets within the trust, which can include real estate, bank accounts, investments, etc.

- Executor: Manages the entire estate, including assets not placed in a trust.

Process:

- Successor Trustee: Avoids probate, providing privacy and potentially reducing costs.

- Executor: Must navigate the probate process, which is public, lengthy, and costly.

Flexibility:

- Successor Trustee: Can often act immediately upon the original trustee’s death or incapacitation, providing a smoother transition.

- Executor: Must wait for court validation, which can delay the management and distribution of assets.

Trust vs. Will

A successor trustee enjoys many advantages that an executor does not. Similarly, a revocable living trust carries numerous advantages that a last will and testament does not. Which of these legal documents is best for your estate planning?

Most Californians opt to use a revocable living trust-based estate plan. But if you have a very small estate valued at less than the current California probate threshold of $184,500, a will-based estate plan may be adequate for your needs. Consult an experienced estate planning attorney for help deciding what type of estate plan is best suited for your personal circumstances.

If you have any questions about this topic, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.