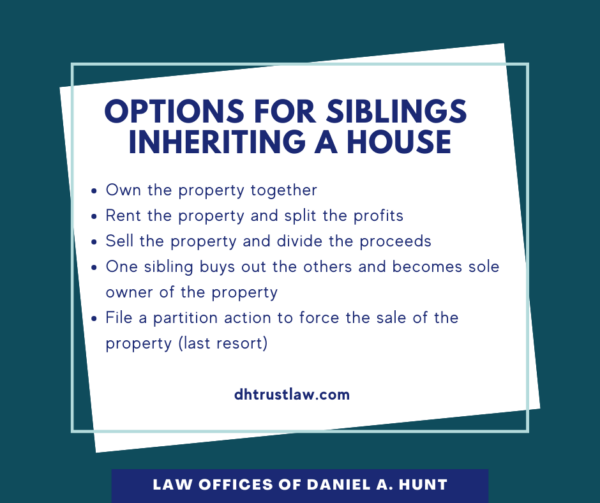

Options for Inheriting a House with Siblings

When multiple siblings inherit a house, such as a family home or vacation home, during a trust or estate administration, they don’t always agree on what to do with the property. Sometimes one or more siblings want to keep the home, and another sibling wants to sell it. These situations can be complex and difficult to resolve. Here are five options for inheriting a house with siblings.

Siblings Own the Property Together

If all the siblings inherit the property equally and the siblings agree to share ownership, you’ll need to decide how to hold title on the inherited home. Tenants in common and joint tenancy are the two main options.

Tenants In Common

If the title is held as “tenants in common”, each sibling holds an interest in the property, which can be divided equally or in different percentages. All owners on the title have a claim, so no single individual can claim ownership. This means that each owner can sell or transfer their share in the property to another person without needing approval from the other siblings. If one sibling passes away, their interest passes automatically to their heirs.

Joint Tenancy

If the title is held as “joint tenancy”, all co-owners possess equal shares in the property. Shares of the property can’t be sold without the consent of all the other owners. Ownership isn’t passed down to heirs if a co-owner dies; instead, the deceased sibling’s share would pass to the surviving sibling(s) who are on title.

With joint tenancy, you can transfer your share to another person, but that person would become a tenant in common while the remaining owners would still hold their shares in joint tenancy.

Rent and Split the Profits

If the property is a valuable asset and the siblings want to use it to collect income over an extended period of time, you could create a partnership agreement and rent the property. The agreement would state the amount of rent to be charged, whether you want a short or long-term renter, and how decisions about property maintenance will be made.

The siblings may wish to find an independent property manager to maintain the home. A property manager typically charges a percentage of the rental income as a fee.

Sell the Property

If all of the siblings decide that selling the property is the best option, they can sell the house and divide the sale proceeds as part of the estate. Some advantages of selling the home include receiving an immediate payout and not needing to worry about ongoing property maintenance.

The first step to selling the real property is to seek an appraisal by a professional appraiser. If the siblings sell the home, they should be aware that they may need to pay Capital Gains tax if the home has increased in value since the date they inherited it. Selling the property quickly after inheriting it can help avoid this issue.

Family members can be offered a “right of first refusal” which is a contractual right to buy the property first if they wish to do so and have the funds to make the purchase. However, they would need to pay “open market value”- the same price the home would sell for in the marketplace.

Buyout the Other Siblings

If one sibling wants to purchase the home, and the other siblings want to sell it, then a buyout may be a possible solution. If the estate has enough liquid assets, the estate executor or successor trustee could include the home as part of that sibling’s inheritance and allocate more or all of the liquid assets to the other siblings as an in-kind exchange.

If the estate doesn’t have enough liquid assets or one person’s inheritance would not be enough to purchase the property, the family member who wants to keep the home may be able to buy out the other siblings with their own funds. In a buyout scenario, one sibling buys the portions owned by the other siblings and becomes the sole owner.

A buyout process usually consists of these six steps:

- Get an appraisal to determine the home’s fair market value.

- Add up any debts against the home, and subtract them from the appraisal value.

- Divide the final amount by the number of siblings to determine each person’s share.

- Get funding to cover the other siblings’ shares.

- Buy out siblings and transfer legal ownership.

- Transfer utilities and insurance into the new owner’s name.

If the sibling who wants to buy the home doesn’t have sufficient cash to buy out the other siblings, they may seek an inheritance, trust or probate loan. These types of loans often carry high interest rates, but the buyer could refinance to a mortgage with a lower interest rate later on.

Other potential options may include cash-out refinancing, a home equity loan, or creating a private arrangement with the siblings to repay the loan.

Partition Lawsuit

If the siblings cannot agree on what to do with the home, a last resort would be to file an action to partition the real property. A partition lawsuit basically forces one or more siblings to sell the property.

After filing a partition suit, a judge would evaluate the case and decide what to do with the property. Since a home can’t be split into smaller pieces and divided up like some other assets, the judge usually orders the home to be sold.

During a partition suit, costs may include court filing fees, attorney’s fees, and a court-ordered referee. You would also need to cover the property’s mortgage payments, maintenance, and utilities while you wait for the case to be resolved.

In some extreme cases, a partition lawsuit may be the only way to get a sibling out of an inherited house, especially if they refuse to vacate or negotiate. But because of the expense and family conflict involved with a partition action, it is generally a last resort.

Seek Legal Counsel

For help deciding the best way to deal with an inherited home, seek the counsel of an experienced trust and estate administration attorney. They can provide personalized counsel based on your family’s unique dynamic and circumstances.

If you have any questions about options for inheriting a house with siblings, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.