How to Stop Financial Elder Abuse

As older people begin to lose mental and/or physical capacity, they often need help from family or friends to manage their finances. This can leave them vulnerable to financial elder abuse. If you know an elderly person who is receiving help with their finances, it’s important to learn the signs of financial elder abuse and how to stop it.

What is Financial Elder Abuse?

Discerning financial elder abuse can be tricky, with ample grey area. Is your 80-year-old father’s new 40-year-old girlfriend just trying to help by paying his bills? Or might she be taking advantage of his vulnerability? Is it ok for your mother to make large monetary gifts to her caregiver who complains about financial challenges? Or is your mother’s altruism draining her own financial resources?

The legal definition of financial abuse of an elder or dependent adult is found in the California Welfare and Institutions Code Section 15610.30. This section defines abuse as occurring when a person or entity “takes, secretes, appropriates, or retains real or personal property of an elder or dependent adult to a wrongful use or with intent to defraud, or both.” If an individual assists another person in taking these actions, they are also committing elder abuse.

In order to be considered elder abuse, the perpetrator must act “in bad faith”. This means they “knew or should have known that the elder or dependent adult had the right to have the property transferred or made readily available to the [victim] or to his or her representative.”

The “representative” is usually a conservator, trustee, attorney-in-fact (aka the Power of Attorney agent), or another representative of an older or dependent adult’s estate.

Elder Abuse & Trust Law

Financial elder abuse can overlap in a number of ways with trust & estate law. Some caregivers exert undue influence on the older person to amend their estate plan to benefit themself. Usually, the caregiver’s goal is to gain greater power and control over finances by being named a financial power of attorney agent and/or trustee of their trust.

Financial elder abuse may also occur when a trustee breaches their fiduciary duties in certain ways. Examples include fraud, embezzlement, self-dealing, making improper gifts, or commingling trust assets with personal funds.

Warning Signs

Whether you’ve noticed recent negative changes in an older adult’s wellbeing or financial situation or just feel concerned that someone may be taking advantage of them, here are some warning signs to identify elder financial abuse:

- Unusual activity in their bank account, like unexplained large withdrawals/transfers/wires of funds.

- Sudden changes in banking practices. For example: adding new signatories to their bank signature card or ATM withdrawals by an older person who doesn’t use an ATM card.

- Abrupt changes to a trust, will, power of attorney, or other estate planning or financial documents, especially if initiated by a caregiver.

- A caregiver who seems to be asserting excessive control over an older person’s finances.

- Suspicious checks, especially if the signature appears to be forged or the check description is something like “loan” or “gift”.

- New “best friends” accompanying an older person to the bank.

- Mysterious disappearance of cash or valuables.

- Lowered standard of care (like malnutrition or unsuitable housing), unpaid bills, overdrafts on bank accounts, or an eviction notice.

- Appearance of new, expensive, unnecessary items or services.

- The older person exhibits confusion or a lack of understanding concerning their financial situation.

- The older person exhibits shame or reticence to discuss the concerning situation with others.

If you notice any of these warning signs, there are actions you can take to protect the at-risk older person.

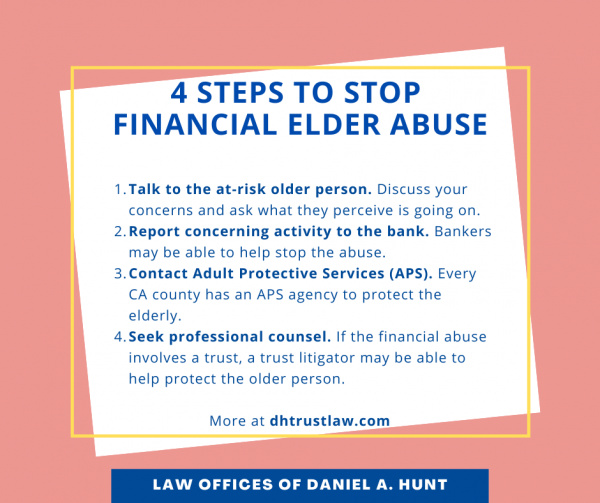

How to Stop Financial Elder Abuse

If you suspect that an elder is being financially abused, here are some suggested steps you can take to address the situation.

- Talk to the elderly person. Discuss the concerning signs you’ve noticed with the person you wish to protect. Give them an opportunity to explain their perspective on what is happening with their finances. There may be a valid reason behind their choices. Explain the concerns you have and express care for them.

- Report the elder financial abuse to their bank. Bankers can sometimes help stop or prevent abuse.

- Contact Adult Protective Services for assistance. Every California county has an APS agency to help elderly and dependent adults who are victims of abuse, neglect or exploitation. APS also provides information and referrals to other agencies and educates the public about reporting requirements and responsibilities under the Elder and Dependent Adult Abuse Reporting laws.

- Seek professional counsel. If the abuse involves an estate plan or trust funds, you may wish to schedule a consultation with a trust & estate litigator who has experience protecting seniors from financial elder abuse. They may be able to help you regain control over the situation and help protect the abused elderly person.

Finding Legal Solutions

If you decide to take legal action to stop financial elder abuse involving a trust, there are two main legal remedies or solutions you can seek:

#1 Breach of Trust Action: A breach of trust action is a request for compensatory relief when a trustee is found to have breached one or more of their fiduciary duties in a way that caused financial loss to the beneficiaries. If granted, the judge will order the trustee to personally reimburse the trust for any damages and potentially lost interest as well.

#2 Trustee Removal: An interested party may petition the court to remove the current trustee if a breach of fiduciary duty has occurred. If a judge rules in a court trial that a significant breach of fiduciary duty has occurred, they will remove the current trustee and install a new, more suitable person to act in this role.

If you have any questions about financial elder abuse or need legal representation to stop it, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.