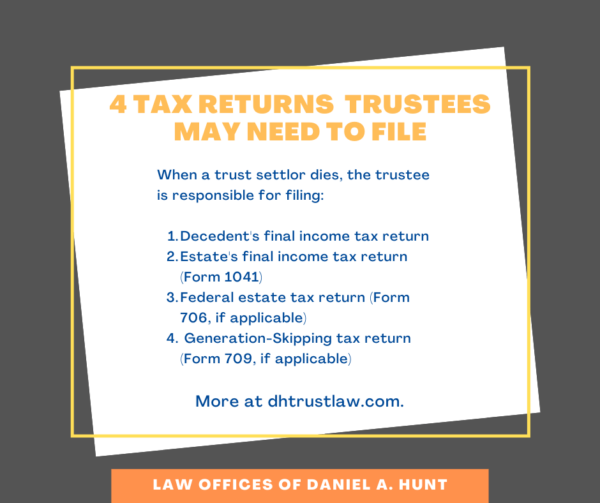

Handling Tax Returns as a Trustee

They say that the only certain things in life are death and taxes. But did you know that dying doesn’t excuse you from paying taxes? It’s true: when a settlor of a trust dies, the successor trustee is responsible for handling the decedent’s unfinished tax business. In total, there are 4 main types of tax returns that trustees have a responsibility to prepare and file.

4 Types of Tax Returns for Trustees

- Decedent’s final income tax return: Internal Revenue Code section 6012(b)(1) states, “If an individual is deceased, the return of such individual required under subsection (a) shall be made by his executor, administrator, or other person charged with the property of such decedent.” As a trustee, you’ll be responsible for filing the decedent’s final tax return and paying any taxes due.

If the decedent was married and the surviving spouse is still alive, consult with a CPA about possibly filing a joint return with the surviving spouse if this would be advantageous for the estate.

- Final income tax returns for the estate: As trustee, one of the last tasks you will likely perform in your role is filing the final tax return. Form 1041, Income Tax Return for Estates and Trusts, must be filed for “every trust having for the taxable year any taxable income, or having gross income of $600 or over, regardless of the amount of taxable income” (Internal Revenue Code section 6012(b)(4)).

Form 1041 asks the trustee to report:

- The income/deductions of the trust.

- The income that is either being held for future distribution or currently distributed to the trust beneficiaries.

- Any income tax liability of the trust.

- Employment taxes on wages paid to household employees.

In general, the beneficiaries will be taxed on any paid income or distribution they receive from the trust, while the trust is taxed on retained income. If the trust has income exceeding $7,900, it will be taxed at the maximum federal rate of 39.6%. If this is a concern, you may wish to consider distributing income to the beneficiaries before the estate is closed, since they will ultimately be receiving it anyway and this could save the estate money.

- Federal estate tax return: If the gross estate, adjusted taxable gifts, and specific exemptions exceed $11.7 million in 2021 (or $11.58 for deaths in 2020), then the trustee will need to file Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return.

As a trustee of the trust, you are personally liable for filing the estate tax return and paying any tax due. When you file your return, you can protect yourself from this liability by requesting early determination of the tax and discharge from personal liability under Internal Revenue Code section 2204.

- Generation-skipping tax return: Trustees must report generation-skipping transfers and pay any taxes due. These transfers include:

- Taxable termination: Termination of an interest in a trust that results in a distribution to a skip person (IRC section 2612[a]).

- Taxable distributions: Any distribution from a trust to a skip person (section 2612[b]).

- Direct skip: A transfer, subject to federal gift or estate tax, of a property interest to a skip person (section 2612[c]).

A “skip person” is someone who is two or more generations below the transferor, most commonly the transferor’s grandchild. If the decedent made any direct skip transfers before they died that were not previously reported, then the trustee must file Form 709, United States Gift (and Generation-Skipping Transfer ) Tax Return.

If any generation-skipping transfers are occurring after the decedent’s passing under a trust, the trustee must also report those on Form 706.

Determining Final Tax Liability of the Estate

Even if you don’t believe that the final Form 1041 will have any income tax liability, you may still have outstanding tax obligations. This could come from a prior year’s tax return, a state or local government, or even unpaid real estate taxes.

In order to determine the trust’s final tax liability, be sure that you have completed returns for each year of administration and that you have no knowledge of any open issues regarding any of them. Before making any distributions to beneficiaries, be sure to set aside a reserve account with sufficient funds to cover any taxes you think the trust may owe and cover the CPA fee.

Filing a Short-Year Return

Before terminating the trust, you will need to ensure that it has reached zero taxable income and zero tax liability. If the trust terminates before the end of a calendar year, you may consider filing a short-year return.

A short-year return can be useful when closing out a trust administration because for most people, you’ll probably be ready to complete the trust administration before December 31, making it a “short year” (less than 12 months) for tax purposes. A short-year return allows you to complete the trust administration sooner than if you waited out the full remainder of the year.

Prepare a short-year return as you would any other return, with two differences:

- You should fill in the dates of the short year at the top of the return.

- If the current year’s form isn’t available yet, you may use the prior year’s tax form and superimpose the correct year over the printed prior year.

Don’t forget that a short-year return is still due 3.5 months after the end of the year you’ve chosen. So if you choose to end the year on June 30, your short-year return would be due on October 15 (not April 15).

If you have any questions about preparing tax returns as a trustee or would like a referral to a skilled Certified Public Accountant, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.