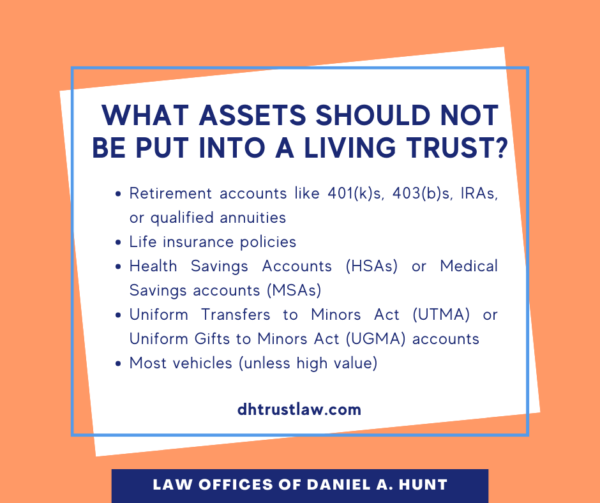

What Should You Not Put Into a Living Trust?

After you create a revocable living trust, the next essential step is funding the trust by transferring assets into it. But not all assets can or should be transferred into a trust! What should you not put into a living trust? Here’s an overview of which assets to leave out of your revocable living trust.

Retirement Accounts

Retirement accounts such as 401(k)s, IRAs, 403(b)s, and qualified annuities should not be transferred into a trust because a trust is a separate legal entity. That means that transferring the account into a trust would count as a taxable account withdrawal and may also carry early withdrawal penalties.

Instead, list a beneficiary on your retirement account. The beneficiary can either be a specific desired beneficiary or your living trust (if you want the funds distributed as outlined in your trust). However, make sure you consult with an experienced estate planning attorney to make sure your trust is adequately set up for being a qualified receiver of such an account.

Life Insurance Policies

Life insurance policies are another asset that cannot be transferred into a revocable living trust. Instead, you should designate beneficiaries for your life insurance policy to ensure the proceeds are distributed to your desired recipients.

If you own a sizable life insurance policy or have a large estate that may incur estate tax once the policy is paid out, you might consider creating an Irrevocable Life Insurance Trust (or ILIT). This irrevocable trust owns and controls one or more term or permanent life insurance policies. Upon your death, it would manage and distribute the policy proceeds according to your wishes.

Consult an experienced estate planning attorney for help deciding whether an ILIT is right for you.

Health Savings Accounts (HSAs) and Medical Savings Accounts (MSAs)

A Health Savings Account (HSA) or Medical Savings Account (MSA) allows you to pay for medical expenses with pretax income. These accounts belong to individuals and cannot be transferred to a jointly owned trust. Instead, you can name your living trust as the beneficiary of your HSA or MSA. If you’ve already named a spouse as the primary beneficiary, you could name your trust as the secondary beneficiary.

UTMA and UTGA Accounts

Uniform Transfers to Minors Act (UTMA) accounts or Uniform Gifts to Minors Act (UGMA) accounts designate a minor child as the account owner while a donor or custodian manages the funds. These irrevocable accounts give the child full access to the funds when they reach the legal age of 18.

By contrast, a living trust is revocable and trust funds are managed by a trustee. A living trust offers more control over how funds are used and when a child can access them. You may use one of these tools or the other or both, but you cannot transfer a UTMA or UTGA account into a revocable living trust.

Vehicles

Most vehicles do not need to be transferred into a revocable living trust unless you own a very high-value or collectible car. The value of a typical vehicle is much less than the California probate threshold of $184,500 and therefore will not trigger a California probate proceeding.

To transfer a vehicle to a trust, you must fill out the required DMV paperwork and follow their procedures carefully to avoid any additional use tax or required smog re-certification. In addition, if you later decided to sell the vehicle, it would be a hassle to remove it from the trust to complete the sale.

Instead, your loved ones can consult the California DMV website for instructions on how to transfer your vehicle post-death.

Personal Belongings with Low Monetary Value

Items like clothing, furniture, family heirlooms, and small personal effects may carry value in the eyes of your loved ones. But most personal belongings do not have a title and can’t be transferred into your revocable living trust.

Your estate plan should include a document called a General Assignment and Transfer which states your intent to assign all your assets into your trust.

You can also use a letter of instruction to outline your wishes for specific items. A letter of instruction (also known as a letter of intent) is an informal supplement to an estate plan that provides your successor trustee or executor with detailed information concerning your wishes for your personal property after you pass away.

Consult an Estate Planning Attorney

When it comes to deciding which assets to transfer into a revocable living trust and which to leave outside of the trust, seek legal advice from an experienced estate planning attorney. An estate planner can walk you through how to best handle each type of asset to achieve the outcome you desire.

If you have any questions about what you should not put into a living trust, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.