Do You Need to Open a California Probate?

Do you need to open a California probate? This is a common question for those whose loved one has recently died. Probate is when the court supervises the processes that transfer the legal title of property from the estate of the person who has died (the “decedent”) to their beneficiaries. But probate is not always necessary after every death.

Determining how to administer an estate post-death depends on the size of the estate, how the assets were titled, and what estate planning documents the decedent created before they died.

When Can a California Probate Be Avoided?

You likely will not need to open a California Probate in the following five scenarios:

1. The estate is worth less than the cut-off amount.

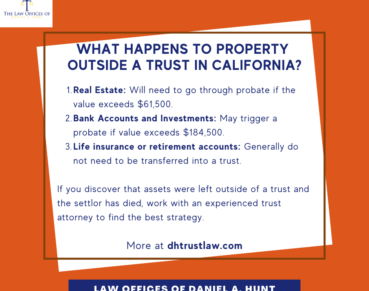

If the estate or asset qualifies as a “small estate”, you may not need to open a full probate matter. In 2022, if the estate or asset is worth less than $166,250 (including real property) or the sole asset is a piece of real estate worth less than $61,500, you can probably avoid probate with a small estate affidavit. Consult an experienced probate lawyer for help determining the best strategy.

2. Your spouse has died and your assets were all “community property.”

Since California is a “community property state”, this means that the widowed spouse has a “right of survivorship”. “Community Property with Right of Survivorship” means that when the first spouse or partner dies, the couple’s property automatically belongs to the survivor. The surviving spouse will not need to open a full probate.

3. The decedent owned all assets in joint tenancy with someone else.

If all of the estate assets are titled in joint tenancy with another person, such as a partner or child, the joint tenant will inherit those properties at the decedent’s passing. However, if the surviving tenant does not add a beneficiary or another joint tenant to the asset, a probate may be triggered when they pass away.

4. The decedent created a revocable living trust and transferred all estate assets of value into the trust.

A revocable living trust avoids a California Probate and will be administered privately by the successor trustee.

5. The decedent’s only assets are retirement accounts or life insurance.

Retirement accounts and life insurance policies are paid out upon the owner’s death to the designated beneficiary. They do not pass through the Probate Court system, unless no beneficiary is designated on record for the asset.

When to Open a California Probate

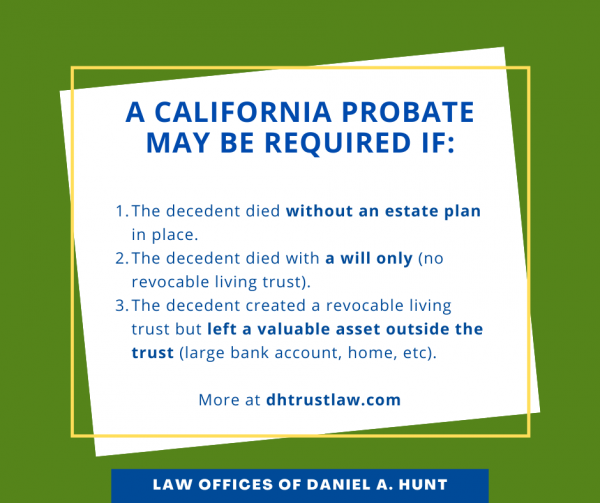

While some families may be able to avoid probate due to estate size or estate planning, you likely will need to open a California probate under the following circumstances:

1. The decedent died with no estate plan at all in place.

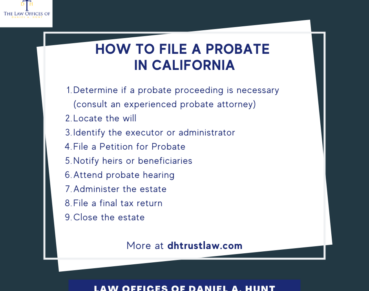

When a person dies without ever creating a Last Will & Testament, this is called dying “intestate”. Assuming none of the previously described exceptions apply, someone (usually a family member) will need to petition the Probate Court to be appointed as the estate’s “personal representative” or “administrator”. This individual will handle the estate administration and ultimately distribute the assets to the decedent’s heirs.

2. The decedent died with only a will (no trust).

While a revocable living trust avoids probate, a Last Will & Testament does not. The executor named in the will must lodge an original copy of the decedent’s will with the Probate Court and initiate the process. Once the probate is complete and the judge grants permission, the executor will distribute estate assets as outlined in the will. The whole process often takes 10-18 months or more in California.

3. The decedent created a revocable living trust but failed to properly transfer a valuable asset into it.

Even with the best of intentions, sometimes assets are inadvertently left outside of a trust. Maybe the settlor never got around to changing the title on a large bank account. Maybe they refinanced their home and the house never got put back into the trust after the loan company took it out to complete the refi. If an asset is left outside of the trust that exceeds the cut-off amount, the successor trustee may need to administer the trust AND open a probate.

Estate administration can be complex. You’ll want an experienced probate lawyer on your side to guide you through each step and offer sound advice based on years of experience navigating the probate system. If you have any questions about whether you need to open a California Probate, feel free to contact our office.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.