Do Trusts Pay Taxes?

Trusts are versatile tools in estate planning, offering benefits like asset protection, privacy, and controlled distribution of assets. But many people wonder, “Do trusts pay taxes?” Understanding how trusts are taxed is crucial for anyone considering setting up a trust or currently managing one. In this post, we’ll delve into the different types of trusts and how each is taxed.

Types of Trusts

Trusts can generally be categorized into two main types: revocable trusts and irrevocable trusts. The taxation of a trust depends on its classification.

Revocable Trusts

A revocable trust, also known as a living trust, can be revoked or amended by the settlor (the person who creates the trust) at any time during their lifetime.

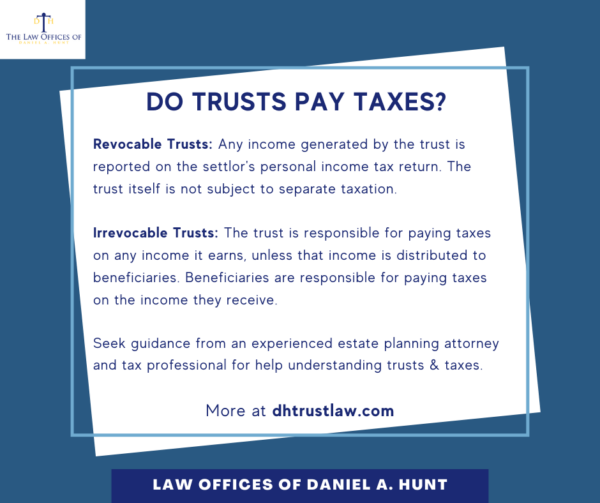

Since the settlor retains control over the assets in a revocable trust, these assets are considered part of the settlor’s estate for tax purposes. Consequently, any income generated by the trust is reported on the settlor’s personal income tax return, and the trust itself is not subject to separate taxation.

Upon the settlor’s death, the trust typically becomes irrevocable, and different tax rules may then apply.

Irrevocable Trusts

An irrevocable trust cannot be easily modified or terminated by the grantor once established. This type of trust is often used for asset protection and estate tax reduction.

Irrevocable trusts are considered separate tax entities. They must obtain their own tax identification number and file their own tax returns. The trust is responsible for paying taxes on any income it earns, unless that income is distributed to beneficiaries. In such cases, the trust beneficiaries may be responsible for paying taxes on the income they receive, reported on a Form K-1 issued by the trust.

How Trusts Are Taxed

Trusts are subject to federal income tax, and the rates can be quite high. For 2024, the trust tax brackets are as follows:

- 10% on income up to $3,050

- 24% on income over $3,050 but not over $9,850

- 35% on income over $9,850 but not over $13,450

- 37% on income over $13,450

To file a federal income tax return, use Form 1041.

Trusts also have to pay taxes on capital gains. Capital gains taxes are levied on the profit when a trust asset is sold. Capital gains tax rates depend on what was sold, how long you owned it before selling, your taxable income, and your filing status. Consult a tax professional for advice on managing trust investments to optimize tax efficiency.

Trust Distributions

When a trust distributes income to beneficiaries, that income may be deductible for the trust, reducing its taxable income. However, the beneficiaries must then report and pay taxes on this distributed income on their personal tax returns. This process can help reduce the overall tax burden, as beneficiaries may be in lower tax brackets than the trust.

Estate Taxes and Trusts

One of the main advantages of using an irrevocable trust is its potential to reduce estate taxes for large estates. By transferring assets into an irrevocable trust, the grantor removes them from their taxable estate, which can help reduce or eliminate estate taxes upon their death. However, it’s important to work with an experienced estate planning attorney to ensure compliance with tax laws and regulations.

If you have any questions about trusts paying taxes, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.