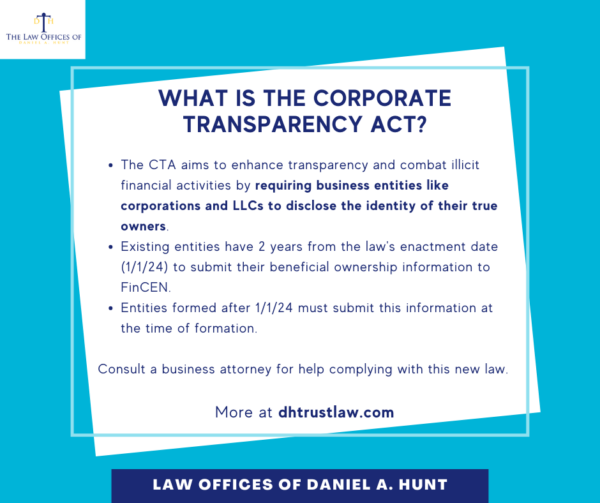

What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA) is a piece of legislation passed by the U.S. Congress in January 2021 as part of the Anti-Money Laundering Act of 2020. Its goal is to enhance transparency and combat illicit financial activities by requiring businesses to disclose the identity of their true owners, also known as beneficial owners. This law addresses a critical loophole in the U.S. financial system where shell companies were often used to conceal ownership, facilitating activities like money laundering, tax evasion, and corruption.

Key Provisions of the CTA

The Corporate Transparency Act has several important provisions aimed at creating a more transparent corporate environment.

Reporting Requirements

Under the CTA, most companies formed or registered to do business in the U.S. must report identifying information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. Beneficial owners are individuals who own or control at least 25% of a company or exercise significant control over it.

The beneficial ownership interest report must include the following information:

- Full legal name

- Date of birth

- Current residential or business address

- A unique identification number from an acceptable document such as a passport or driver’s license

Who Must Report?

The CTA applies broadly to many types of entities, including:

- Corporations

- Limited liability companies (LLCs)

- Similar entities formed under state law

However, the Act does carve out several exemptions. Larger businesses, certain financial institutions, and entities that already report information to regulatory agencies, like publicly traded companies, are not required to submit these reports.

Timing for Reporting

The time frame for reporting depends on whether the entity is a new or existing one.

Existing Entities: Companies formed before the CTA’s effective date have two years from the law’s enactment of January 1, 2024, to submit their beneficial ownership information.

New Entities: Any company formed or registered after the enactment of the CTA on January 1, 2024, must report this information at the time of formation or registration.

Penalties for Non-Compliance

Failure to comply with the CTA’s reporting requirements can result in severe penalties, including:

- Civil penalties of up to $500 per day of non-compliance

- Criminal fines of up to $10,000

- Imprisonment of up to two years

Impact on Businesses and Privacy Concerns

While the CTA is primarily aimed at curbing financial crimes, many small businesses and entrepreneurs have raised concerns about the potential for privacy violations, given the sensitive nature of the information being reported.

The legislation, however, seeks to address this by ensuring that the reported data is not publicly accessible. The information submitted to FinCEN is intended for use by law enforcement and authorized government agencies only.

Benefits of the Corporate Transparency Act

The benefits of the CTA include:

- Preventing Financial Crimes: The CTA is designed to prevent the use of anonymous shell companies for illicit activities like money laundering, terrorist financing, and tax evasion.

- Increased Global Compliance: The United States was one of the few major countries without a beneficial ownership registry, putting it behind in global financial transparency efforts. The CTA helps align U.S. practices with international standards set by the Financial Action Task Force (FATF).

- Improved Trust in Business: Greater corporate transparency enhances trust in the U.S. financial system. It makes it easier for law enforcement agencies and financial institutions to know who they are doing business with and to identify suspicious activities.

The Corporate Transparency Act represents a significant step forward in the fight against illicit financial activities in the U.S. By requiring companies to report their beneficial ownership information, it closes a major loophole that has long allowed criminals to hide behind anonymous corporate entities. While there are valid concerns about privacy and compliance burdens for small businesses, the long-term benefits of a more transparent and trustworthy financial system are likely to outweigh these challenges.

Businesses that may be affected by the CTA should ensure they are familiar with its reporting requirements and seek legal advice from a business planning attorney to avoid penalties for non-compliance.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.