How to Claim a Deceased Person’s Bank Accounts

Losing a loved one is never easy, and dealing with the practicalities afterward can be overwhelming. Among the many tasks that need attention is handling the deceased’s finances, including any bank accounts they may have held. The process of claiming a bank account after death varies based on a number of factors. In this guide, we’ll explain how to claim a deceased person’s bank accounts.

Determining Bank Account Status

The first step to claiming a bank account is determining the status of the account. Most bank accounts fall into one of the following four categories:

- Jointly owned accounts

- Payable-on-death or transfer-on-death accounts

- Accounts held in a trust

- Accounts with no beneficiary

Here’s how to handle each type of account.

Jointly Owned Accounts

If the co-owner of a jointly owned bank account passes away, in most circumstances, the surviving account holder(s) will automatically assume ownership of the account, as long as the account carries the right of survivorship. This right of survivorship is usually automatic for joint accounts.

This is a common scenario for married couples where one spouse passes away and the other surviving spouse resumes managing the account.

Payable-on-Death or Transfer-on-Death Accounts

Since payable-on-death accounts (PODs) and transfer-on-death accounts (TODs) must designate a beneficiary, they are not subject to the California probate process. The payable-on-death beneficiary can claim the bank account proceeds by going to the bank with a copy of the death certificate and proof of identification.

Note that creditors may still bring an action against the estate for their claim, and if successful, they can collect against the beneficiary directly against their pro-rata share.

Bank Accounts Held in a Trust

Assets held by a trust are not subject to a probate proceeding. The successor trustee should take control of these assets during the trust administration.

In most cases, the trustee can take control of a trust-owned bank account by showing the bank a copy of the Certification of Trust, a copy of the decedent’s death certificate, a driver’s license, passport, or other government-issued ID, and proof of the Trust’s tax identification number.

Policies and requirements may vary by bank, so contact the bank ahead of time to see what that specific financial institution requires.

Bank Accounts with No Beneficiary

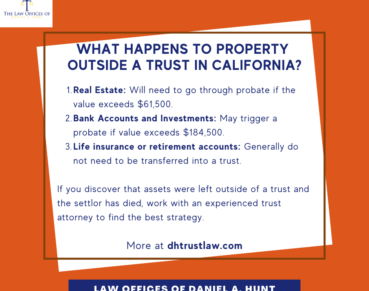

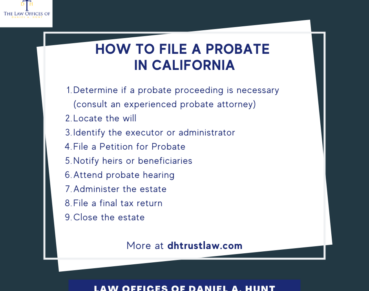

If the decedent owned a bank account and didn’t name a beneficiary or failed to transfer the account into their trust, the account may need to pass through a California probate proceeding.

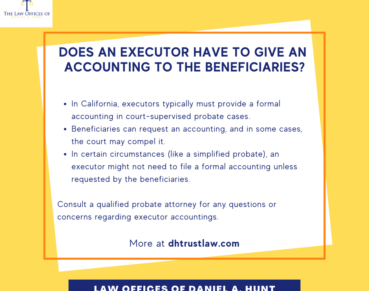

Once the executor or estate personal representative receives letters testamentary from the court, they can take control of estate assets, including bank accounts. Assets will be distributed to the decedent’s heirs or beneficiaries at the end of the estate administration.

For very small estates worth less than the probate threshold of $184,500, a small estate affidavit may be used to claim assets such as bank accounts without a full probate proceeding.

If a decedent created a trust and inadvertently left a bank account out of the trust, the successor trustee should consider filing an 850 Petition (also known as a Heggstad Petition) with the California Probate Court. This strategy can be used when an asset was stated as an asset of the trust but the title was not transferred to the decedent’s revocable living trust.

Seek the counsel of an experienced trust administration attorney or probate attorney for help claiming bank accounts with no beneficiary.

How Long Does It Take To Claim a Bank Account?

Jointly owned bank accounts and payable- or transfer-on-death accounts can generally be dealt with immediately. If the bank account is part of a trust estate or a probate estate, the successor trustee or executor can take control of the account once they have the required paperwork.

Estates under the probate threshold value must wait 40 days from the date of the decedent’s death to collect the assets.

Trust or estate assets may only be distributed to beneficiaries or heirs at the end of the trust or probate administration process. A typical trust administration takes an average of 4-6 months and the average California probate matter is 12-18 months.

In certain situations, claiming a deceased person’s bank accounts can become complex. An experienced trust & estate attorney can guide you through the process so you can complete this task in the most efficient manner possible.

If you have any questions about how to claim a deceased person’s bank accounts, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.