What is a Charitable Remainder Unitrust (CRUT)?

What is a Charitable Remainder Unitrust (CRUT)? If you’re looking for a way to provide an income to yourself or another loved one over an extended period of time while ultimately supporting your favorite nonprofit organizations, a Charitable Remainder Unitrust may be a useful estate planning tool for you.

What is a Charitable Remainder Unitrust?

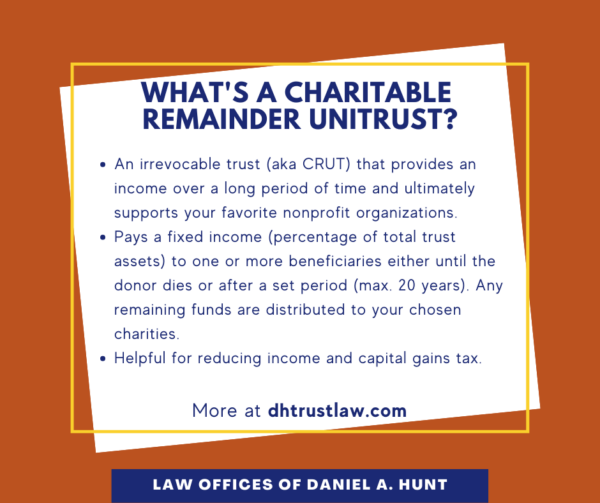

A Charitable Remainder Unitrust (or CRUT) is a type of gift transaction in which a donor (aka “grantor”, “trustor”, or “benefactor”) contributes assets to an irrevocable trust. After creation, the trust can’t be altered, but additional assets may be contributed to the trust.

The CRUT will make distributions to one or more beneficiaries either until the donor dies or after a set period not to exceed 20 years. The payment is based on a fixed percentage of the trust assets and is recalculated annually. This means it may increase over time if additional contributions are made to the trust or if the trust assets increase in value.

When the trust dissolves, any remaining assets in the trust are donated to one or more named beneficiaries, which may be public charities or private foundations.

What Assets Can Fund a CRUT?

You can fund a Charitable Remainder Unitrust with the following types of assets:

- Cash

- Publicly traded securities

- Some types of closely held company stock (but NOT S-Corp stock)

- Real estate

- Private business interests

Types of CRUTs

There are four types of Charitable Remainder Unitrusts:

- Standard Unitrust: Provides an income based on a fixed percentage stated in the trust of at least 5%, which is then multiplied by the fair market value of the trust assets at the beginning of each year.

- Net Income Unitrust: Provides annual payments that can either follow the standard unitrust process or it can provide net income of the trust, whichever is lower. This type of trust is usually preferred by younger donors who want to wait until later to get larger payments.

- Flip Unitrust: Begins as a net income unitrust, but it only pays beneficiaries based on actual trust earnings. This type of trust is usually set up when the trust is funded with a non-liquid asset like real estate. The trust states that at a certain future date, the asset will be sold and it will then operate as a standard unitrust. This type of trust may be preferred for a donor who is funding retirement.

- Net Income with Makeup Unitrust: A net income unitrust that has the ability to make up income in subsequent years if the income earned is less than the stated payout rate.

CRUT vs. Charitable Remainder Annuity Trust (CRAT)

There is another type of Charitable Remainder Trust called a Charitable Remainder Annuity Trust (or CRAT). A CRAT pays a fixed income in the form of an annuity to one or more beneficiaries. The annuity value is a fixed percentage of the original value of the trust assets and must be no less than 5% and no more than 50%.

What’s the difference between a CRUT and a CRAT? A CRAT pays the noncharitable beneficiary the same income every year. Since the value of the CRUT is recalculated every year, the payout differs based on a fixed percentage of that revaluation. A CRUT also lets you make additional contributions, which would change its annual value, while a CRAT does not allow for additional contributions.

Advantages of a CRUT

Here are three advantages of using a CRUT:

#1 Reduce Capital Gains Tax: If you place highly appreciated assets (such as real estate) in your CRUT, it will be exempt from capital gains tax when sold. This preserves the full fair market value of the assets for the beneficiaries.

#2 Reduce Income Tax: When you fund a CRUT, you have the option to take a partial income tax deduction, based on a calculation on the remainder distribution to the charitable beneficiary.

#3: Tax Exempt: Any investment income to the trust is tax exempt, although the named income beneficiary will pay income tax on the income stream received.

Disadvantages of a CRUT

There are two main disadvantages of using a CRUT:

#1 Irrevocable: After you create a CRUT, you as the trustor wouldn’t be able to access the trust funds and it would be difficult to change the trust terms.

#2 Cost and Complication: A CRUT can be complicated and costly to create and administer over the years. Always consult with an experienced estate planning attorney to confirm if this type of trust is the best option for your estate planning needs.

How do you create a CRUT? Meet with an experienced estate planning attorney who can draft the trust and advise you on how to fund it. If you have any questions about a Charitable Remainder Unitrust, or any other type of trust, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.