A Guide to Intestate Succession in California

Many Californians do not have a last will and testament, a trust, or any other type of estate planning document. Dying without a will in California results in a person’s estate being distributed according to California probate laws. In California, when someone dies without a valid will in place, they have died intestate. California’s intestacy laws set forth how probate courts should distribute a person’s assets when there is no will in place. As a result, the deceased person’s assets may not be distributed to the people or charities they would have chosen.

Understanding Intestate Succession in California

Intestate succession occurs when someone dies without a valid will. Every state has intestacy laws that govern who receives the assets of the deceased individual. The family members designated to receive the deceased individual’s assets are called heirs. The heirs are entitled to receive part of the estate depending on whether they are the deceased individual’s next kin. As next of kin, the decedent’s surviving spouse and children will inherit their separate property.

Not All Property Passes Through Intestate Succession in California

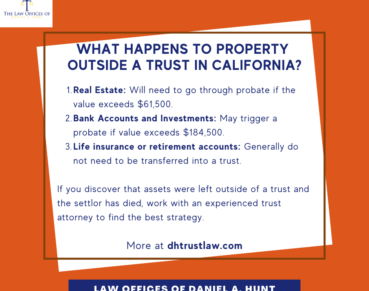

It is important to note that not all property will be subject to intestate distribution. Property that falls into the category of probate property will be distributed to the decedent’s next of kin. The following types of property are not considered probate property; thus, they will not pass through the intestate succession process:

- Any of the decedent’s property that is held in a living trust

- Life insurance proceeds with a named beneficiary

- Retirement account funds including 401(k)s and IRAs with a named beneficiary

- Payable on death bank accounts

- Property that the decedent owned in joint tenancy with the right to survivorship

Who Inherits Property Through Intestate Succession?

The person or people entitled to the decedent’s property through intestate succession are called the heirs at law. Heirs at law are people who are legally entitled to obtain another person’s property after their death. California has stringent intestacy laws that allow relatives to inherit the decedent’s property based on how closely related they were to the decedent. These intestacy laws set forth rules of descent and distribution based on kinship.

What happens if an heir at law passes away shortly after the decedent dies? For example, suppose an unmarried parent has one adult child. The parent and child are both involved in a car accident. The parent passes away immediately, but the child survives until a day later, when they too pass away. In this situation, the child would not inherit the property. In California, an heir must outlive the decedent by at least 120 hours.

The Decedent Was Married

When the decedent was married at the time of death, the decedent’s share of community property will pass to the surviving spouse. If the decedent did not have a surviving child, parent, brother, sister, or child of a deceased brother or sister, the spouse would inherit 100% of the separate property owned by the decedent.

However, if the decedent had surviving children, the spouse and the surviving children will receive a portion of the decedent’s property. The percentage given to the surviving spouse and child or children depends on how many children survived their parents. If the decedent was legally separated at the time of their death, the surviving spouse may still be entitled to the property even if they didn’t live together at the time of death.

The Decedent Was Not Married

When a decedent is not married or does not have a domestic partner when they pass away, the following heirs at law will have a preference in this order:

- Children: The decedent’s estate will be divided among their children equally

- Parents: The decedent’s estate will be divided among their parents if they do not have a surviving spouse or any children

- Siblings: If the decedent is not survived by their children, a spouse, or parents, their siblings will receive an equal share of the estate. In California, half-siblings inherit their total proportional share whether or not the sibling in the decedent had a different mother or father.

- Grandparents: If the decedent is not survived by any spouse, children, or siblings, their estate will pass on to any surviving grandparents

In rare cases when the decedent does not have any surviving spouse, children, parents, siblings, grandparents, aunts, uncles, nieces or nephews, cousins, etc., the property will escheat to the State of California.

Problems With Intestate Succession

Intestate succession may seem like a simple process, but complications can and do arise. We most often see issues between the biological children of the deceased individual and a stepparent. For example, if the decedent was married multiple times and has numerous children from different wives, emotions can become heated, especially in the wake of a loved one’s death.

In some cases, children have difficulty accepting the new spouse and do not think their step-parents should be entitled to anything, especially if the marriage was a new one. If you have any legal issues related to intestate succession, we recommend discussing them with an experienced lawyer as soon as possible.

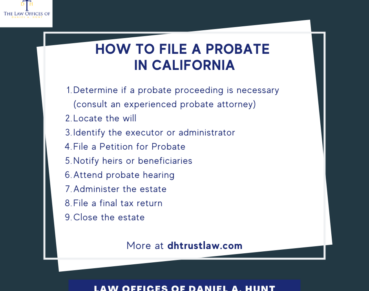

Discuss Your Case With a Sacramento Probate Lawyer

Has your loved one passed away without a will? Do you have questions about the laws of intestate succession in California? If so, the experienced probate lawyers at the Law Office of Daniel Hunt are here to help. Going through the probate process when your loved one did not have a will does not have to be expensive. One of our lawyers can help you protect your interests and guide you through the probate process. Contact us today to schedule your initial consultation with our Sacramento estate planning law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.