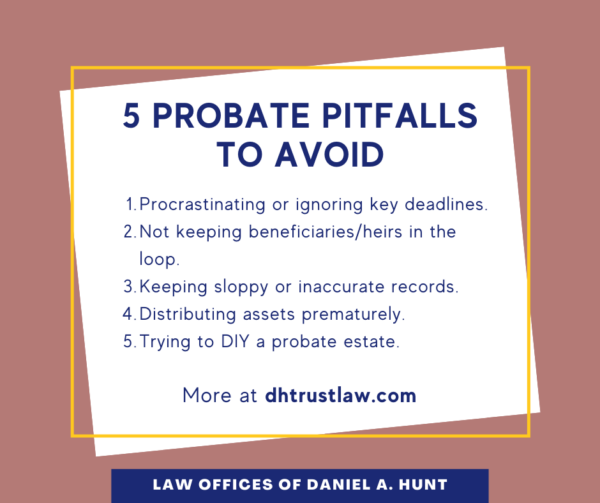

5 Probate Pitfalls to Avoid

The probate process is complex and riddled with pitfalls. If you’re like most Personal Representatives, you may be administering an estate for the first time. Based on our firm’s many years of experience navigating the Probate Court, here are 5 probate pitfalls to avoid.

Pitfall #1: Procrastinating or ignoring key deadlines.

When a loved one passes away, the sheer amount of work to be done can feel overwhelming. While the estate doesn’t need to be administered immediately after death, procrastination is not wise either.

Once the decedent has been laid to rest and any funeral/memorial service has passed, it’s important to start and pursue the probate process in a timely manner. An experienced probate attorney can help you observe your duties and meet all deadlines throughout the process.

What happens if you ignore or miss probate deadlines? First, this negligence results in a probate process that takes MUCH longer than it should. The Probate Court encourages probate matters to be completed within one year of the decedent’s death. If the Personal Representative can’t meet that time frame, they must file a status report explaining the situation.

Another danger? The longer the administration, the higher the risk of the beneficiaries or heirs getting frustrated and seeking to sue and replace you. The best remedy for all of these issues? Hiring a trustworthy attorney who will help you observe your fiduciary duties with efficiency and skill.

Pitfall #2: Not keeping the beneficiaries/heirs in the loop.

The Personal Representative has a duty under the Probate Code to communicate reasonably well with the beneficiaries and heirs. We encourage our clients to communicate clearly and frequently with those who are entitled to information concerning the estate.

When beneficiaries and heirs are kept in the dark, they may become anxious and frustrated. They may seek their own legal counsel to represent their interests and potentially sue or remove the uncommunicative Personal Representative. Avoid this situation by sending out appropriate notices and regular updates to all those who are entitled to receive them.

Pitfall #3: Keeping sloppy or inaccurate records.

When the time comes to present an accounting of your actions as Personal Representative, accurate records will be crucial for preparing an accounting that adds up. If your accounting reflects missing funds, that may raise a red flag and create suspicion. If you want your numbers to add up correctly in the end, it’s helpful to keep careful records from day one.

Keeping accurate, thorough records proves that you observed all of your fiduciary duties. If any accusations of misconduct should ever arise, these records will vindicate you by demonstrating your innocence.

Pitfall #4: Distributing assets prematurely.

As Personal Representative, your job is to inventory the estate assets. When you’re ready to close the estate, you’ll file a Petition for Final Distribution with the court. Assets should only be distributed to the heirs or beneficiaries after the court has approved this petition at the final hearing.

What happens if you distribute estate assets prematurely? You may find yourself personally liable for these actions or needing to track the assets down to get them back. This is a major liability and hassle for you. Avoid it by distributing nothing until the appropriate time at the conclusion of the probate process.

Pitfall #5: Trying to DIY a probate estate.

A fair number of our clients are Personal Representatives who come to us for help fixing an estate administration they have completely bungled. While a few savvy folks may be able to successfully administer a very simple estate on their own, many people eventually realize they are in way over their heads. Probates can get incredibly messy!

Which makes more sense: Finding a probate lawyer at some point down the line to fix your mistakes and hopefully prevent you from getting sued? Or hiring an experienced probate lawyer at the beginning to keep you on track and get it done efficiently? We believe that if a job is worth doing, it’s worth doing right!

If you have any questions about probate, feel free to contact our law firm. We are happy to help you avoid these five pitfalls and many more.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.